Natural Gas News – August 13, 2024

Natural Gas News – August 13, 2024

Futures Rally as Supply Tightens and Weather Boosts Demand

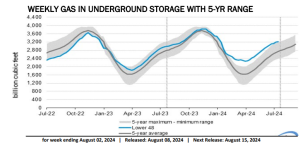

Natural gas futures rally as traders anticipate higher demand, driven by rising temperatures across the U.S. NatGasWeather forecasts stronger demand ahead as temperatures climb to 100°F in key U.S. regions. Bullish bets hit a six-week high as money managers unwind short positions and expect cooling demand to soar. Supply concerns mount with a rare summer storage draw expected, tightening the supply-demand balance further. Russian gas supplies to Europe face uncertainty as the current transit deal through Ukraine nears expiration. U.S. natural gas futures edged higher on Tuesday as traders anticipated increased weather-driven demand. This follows a breakout rally on Monday, confirming last week’s closing price reversal bottom. The rally is supported by a significant rise in bullish bets from money managers, with da… For more info go to https://tinyurl.com/3zekux46

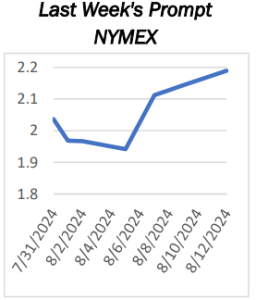

Henry Hub Gas Futures Hold Increases As Market Fundamentals Tighten

NYMEX prompt-month natural gas futures prices held on to prior week increases in Aug. 12 trading amid growing signs that recent cuts to US gas production are beginning to tighten domestic market supply. In morning trading, the Henry Hub prompt-month futures contract climbed to its highest since early July, changing hands at just over $2.25/MMBtu. By mid-session, September gas prices had retreated, but continued to trade rangebound from about $2.15-$2.20, data from CME Group showed. Over the past week, prompt month futures rose roughly 30 cents, or more than 15%, rebounding from lows at under $1.90 in early August, according to S&P Global Commodity Insights data. The rebound in prices comes amid what appears to be an enduring cut to US gas production this month. After

reaching a 22-week… For more info go to https://tinyurl.com/prujwzr6

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.