Natural Gas News – July 23, 2024

Natural Gas News – July 23, 2024

Freeport LNG Resumes, But Market Struggles with Supply-Demand

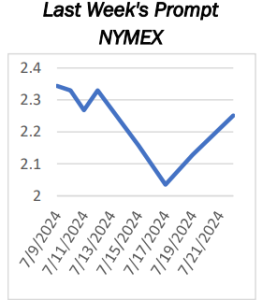

Natural gas futures dip as market grapples with supply-demand dynamics, retreating from Monday’s 4.3% gain. Freeport LNG, the second-largest U.S. exporter, resumes operations, potentially adding 1.0 Bcfd to supply. U.S. natural gas production decreased by over 1 Bcf compared to last week, influencing recent price gains. Natural

gas futures are edging lower on Tuesday, retreating from Monday’s gains as the market continues to grapple with supply-demand dynamics. This downward movement comes after the August contract rose 4.3% to $2.220 per million British thermal units (mmBtu) on Monday, marking the third consecutive session of gainsat that time. At 13:03 GMT, Natural Gas Futures are trading $2.199, down $0.052 or -2.31%. Freeport LNG, the second-largest U.S.

liquefied natural gas exporter, has resumed shipments… For more info go to https://tinyurl.com/swbx5dju

Natural Gas Set to Grow from Long-Term Support

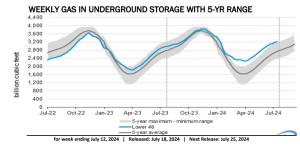

Recent inventory reports indicate a bullish outlook for natural gas prices. Historical price spikes and current technical formations indicate potential investment opportunities for long-term investors. Natural gas prices are trading near the baseline support, indicating that the price is still low. Natural gas is a crucial component of the global energy landscape, widely used for electricity generation, heating, and as a chemical feedstock. Its price is impacted by inventory levels, geopolitical events, and weather patterns, all of which have significant economic implications. Recent inventory reports indicate higher demand and suggest a bullish outlook for natural gas prices. This article presents the technical… For more

info go to https://tinyurl.com/r43ussnc

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.