Natural Gas News – July 11, 2024

Natural Gas News – July 11, 2024

Traders Anticipating Bearish Miss in EIA Report

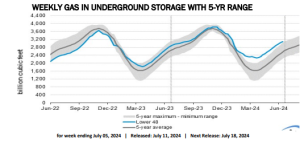

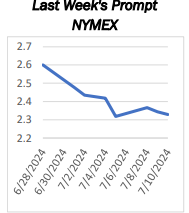

U.S. natural gas futures traded lower as traders awaited the EIA’s weekly storage report. Key support levels are at $2.268 and $2.251. Survey averages for the EIA storage report suggest a build of 54-58.5 Bcf. The Fourth of July holiday and lighter cooling demand may lead to a bearish miss. Feed gas flows to U.S. LNG export terminals rise by 0.6 Bcf/d. However, the Freeport LNG terminal remains offline for the fifth day. U.S. natural gas futures traded lower early Thursday as traders awaited the Energy Information Administration’s (EIA) weekly storage report, due to be released at 14:30 GMT. The market is poised to challenge Monday’s closing price reversal bottom at

$2.268, followed by the April 26 main bottom at $2.251, indicating a bearish chart pattern. At 13:16 GMT, Natural Gas Futures are trading $2.287, down… For more info go to https://tinyurl.com/5eh9uuxv

Gas Sinks With Supply Increases Taking Wind Out Of Rate Cut

Natural Gas dips again on Thursday, testing vital support before a steep decline. Traders see demand slumping with inventories growing quick. The US Dollar index falls to 104.00 in a very soft CPI print. Natural Gas price (XNG/USD) falls near 1% on Thursday despite help from a very soft US Consumer Price Index (CPI) print on all fronts. That support is being matched and fazed out by the swelling storages, despite the local demand. European countries like Spain, Italy and Portugal are seeing a jump in energy demand to fuel air conditioning units, while European storages are filling up at a faster pace, even with elevated demand in the southern countries. Meanwhile, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, sinks in the CPI aftermath. The fact … For more info go to https://tinyurl.com/8x6pj2rj

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.