Natural Gas News – July 2, 2024

Natural Gas News – July 2, 2024

Will Rising Production Continue to Offset Heat-Driven Demand?

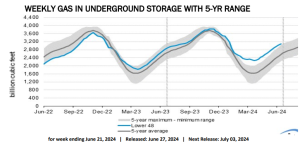

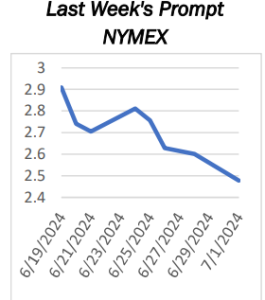

Rising production and high storage levels may continue to outweigh seasonal demand, potentially pushing natural gas prices lower in the coming weeks. Breaking below $2.625 confirmed the double-top on the daily chart, confirming the weakness. Watch for potential support at $2.50, with a breach possibly accelerating downside momentum.

Sustained heatwaves across major consumption regions could provide temporary price support, but may not be enough to reverse the overall bearish trend. Natural gas futures ended the week on a decidedly bearish note, plummeting 7.5% and closing below the critical $2.625 support level. This significant downturn reflects a complex interplay of factors weighing on trader sentiment and prices. Last week, Natural Gas futures settled at $2.601, down $0.211 or – 7.50%. … For more info go to https://tinyurl.com/mr3n9zep

Natural Gas Faces Crucial Moment As Pivotal Support Gives Way

Natural Gas extends its decline and sinks to $2.55 on Monday. China’s demand is less majestic as initially thought. The US Dollar index retraces after the Euro outpaced the Greenback on Monday, offering support to XNG/USD. Natural Gas prices (XNG/USD) are extending losses and are at risk of freefalling after substantial support snapped at the start of the US trading session. The move comes on the back of China cutting its Liquified Natural Gas (LNG)

imports after prices rose above $3.0 in June. It seems that the demand and hunger for LNG in China is not that big once prices are heating up, while European Gas prices are moving higher after a local temperature surge and the energy demand rose again. Meanwhile, the US Dollar Index (DXY), which tracks the Greenback’s value against six major… For more info go to https://tinyurl.com/4z72x6e2

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.