Natural Gas News – June 18, 2024

Natural Gas News – June 18, 2024

Approaching Tropical Storm May Cause Demand Destruction

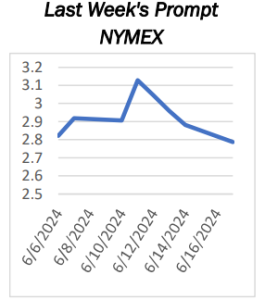

U.S. natural gas futures rise due to profit-taking and short-covering, influenced by Gulf storm uncertainty. Strong production and increased flow capacity cause a fourth consecutive decline in natural gas futures. European gas prices climb as warmer weather increases demand and competition for LNG supplies. U.S. natural gas futures are seeing an uptick on Tuesday due to profit-taking and short covering after a significant four-day decline. This movement is

influenced by uncertainty surrounding a tropical storm in the Gulf of Mexico, although early indications suggest a bearish outlook. At 12:17 GMT, Natural Gas futures are trading $2.838, up $0.050 or +1.79%. Natural gas futures fell for the fourth straight session on Monday, weighed down by strong production levels and increased flow capacity. The mixed weather… For more info go to https://tinyurl.com/3bx7nrmt

Heatwave Forecasts Support Upside Potential for Natural Gas

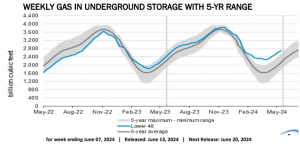

The U.S. Energy Department’s weekly inventory release showed that natural gas supplies increased more than expected. The bearish inventory numbers affected natural gas futures, which settled with a small loss week over week. However, signs of production pullback, resurgence of LNG exports and heatwave-related summer demand are set to support near-term prices. The commodity is already on an upswing, gaining some 30% in May — its best monthly performance since July 2022 — driven by an improved macro backdrop. Considering that the space remains highly susceptible to unpredictable weather patterns that impact prices and market stability, at this time we advise investors to focus on stocks like Coterra Energy CTRA and Cheniere Energy LNG. Stockpiles held in underground storage in the lower 48… For more info go to https://tinyurl.com/yzeuh5kf

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.