Natural Gas News – June 13, 2024

Natural Gas News – June 13, 2024

Weighing Weather and MVP Impact Ahead of EIA Storage Data

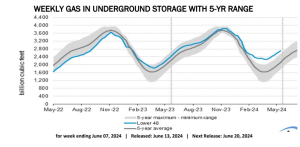

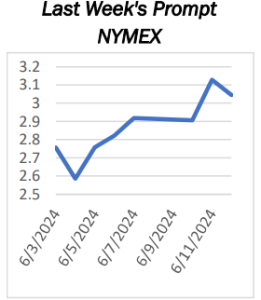

Traders focus on MVP’s potential supply boost and await EIA’s weekly storage report, impacting natural gas futures today. EIA forecasts a 75 Bcf storage increase, with current levels 373 Bcf higher than last year and 581 Bcf above the five-year average. High temperatures across the U.S. from June 13-18 are expected to drive gas demand, with a hot ridge dominating southern states. Natural gas futures declined on Thursday as traders focused on potential supply increases from the Mountain Valley Pipeline (MVP) and anticipated the U.S. Energy Information Administration’s (EIA) weekly storage report. Despite a two-day pullback, the market remains buoyed by expectations of record heat through June, creating a possible “buy the dip” scenario. At 12:22 GMT, Natural Gas futures are trading $2.971, down $0.074 or -2.43%… For more info go to https://tinyurl.com/5rkny75c

Europe’s Natural Gas Prices Jump on Uncertainty Over Russian Supply

Europe’s benchmark natural gas prices jumped by 3% on Wednesday morning after German energy giant Uniper terminated its Russian gas supply contracts, leaving the market concerned about the remaining flows of gas from Russia to Europe. Uniper said today it had decided to terminate its long-term Russian gas supply contracts and thus

legally ended the long-term gas supply relationship with the Russian state-owned company Gazprom Export. The decision was made possible after an arbitration tribunal last week awarded Uniper the right to terminate the contracts and awarded it more than $14 billion (13 billion euros) in damages for the gas volumes that Gazprom

Export has not supplied since the middle of 2022. “This ruling provides legal clarity for Uniper. With the right of termination that we rec… For more info go to https://tinyurl.com/5e9c44zu

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.