Natural Gas News – June 11, 2024

Natural Gas News – June 11, 2024

Volatility Ahead as Supply/Demand Battle Heats Up

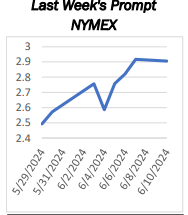

Natural gas futures rise as traders recover losses from Monday’s bearish reversal. Market stays above 200-day moving average, indicating buyer strength. Hot weather across the U.S. expected to drive natural gas demand higher. Midwest to Northeast remains cooler, with highs in the upper 60s to 80s. Producers are ramping up production following a significant price surge in April and May. Europe on track to refill natural gas storage ahead of winter. LNG imports compensate for reduced Russian supplies, with storage levels at 71%. U.S. natural gas futures are trading higher on Tuesday as traders attempt to recoup losses from the previous session. Monday saw a potentially bearish reversal after failing to surpass the May 23 peak of $3.159. Despite early weakness today, the market remains above the 200-day moving averag… For more info go to https://tinyurl.com/3mpn6aja

Reasons Behind Last Week’s Rally in Natural Gas Prices

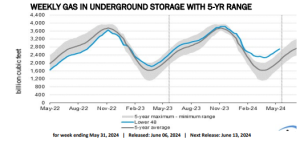

The U.S. Energy Department’s weekly inventory release showed that natural gas supplies increased more than expected. The bearish inventory numbers notwithstanding, futures settled with a week-over week gain on signs of production pullback, resurgence of LNG exports and robust summer demand. To be precise, the fuel reached

a 21-week high on Friday, after gaining some 30% in May — its best monthly performance since July 2022 — supported by an improved macro backdrop. Despite the spike, the space remains highly susceptible to unpredictable weather patterns, impacting prices and market stability. Stockpiles held in underground storage in the lower

48 states rose 98 billion cubic feet (Bcf) for the week ended May 31, above the analyst guidance of a 90 Bcf addition. The increase compared with… For more info go to https://tinyurl.com/2bdxxner

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.