Natural Gas News – May 16, 2024

Natural Gas News – May 16, 2024

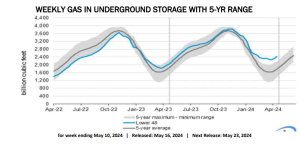

Traders Expecting 76 Bcf Build in Today’s EIA Storage Report

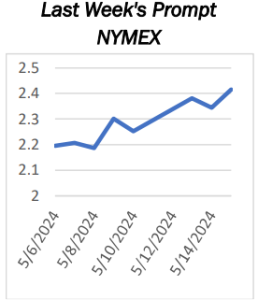

Natural gas futures are climbing on Thursday, driven by anticipation of the government’s weekly storage report due at 14:30 GMT. Traders expect a build of 76 Bcf, potentially causing market volatility. This week has seen strong performance in natural gas, supported by upward revisions in demand projections.At 12:17 GMT, Natural Gas

futures are trading $2.428, up $0.012 or +0.50%. Significant oversupply remains a challenge, with storage levels approximately 31% above seasonal norms. Despite this, the restoration of the Freeport LNG plant and increased flows to major U.S. LNG export facilities, averaging 12.7 Bcfd in May, are providing price support. Traders have shifted their positions from net short to net long, reflecting growing bullish sentiment. This shift is influenced by

increased LNG export capacity and… For more info go to https://tinyurl.com/mrxx7tt9

1 Natural Gas Stock That’s Keeping the Lights On in Europe

Remember the bad old days of two years ago? That’s when Russia invaded Ukraine, and the price of natural gas in Europe soared a few hundred percent. The spike in gas prices was due to the fact that the Russian gas giant Gazprom provided about 35% of all Europe’s natural gas before the war. Flows through four main pipelines from Russia accounted for around 40% of the European Union’s total supplies. Move forward to Europe today, and things have changed… but they’ve also stayed the same. There is still just one company that is supplying 30% of Europe’s natural gas, but it’s not Russian. The natural gas now comes from Norway. Of the more than 109 billion cubic meters of natural gas that Norway exported to Europe last year, roughly two-thirds was marketed and sold by this one company. That… For more info go to https://tinyurl.com/5bn2j7px

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.