Crude Oil Down on US Sanction Speculations and Impacts of Economic Data

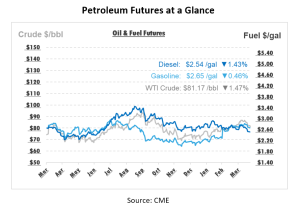

This morning, prompt crude futures fell by over 70 cents, erasing the increases from the overnight session, where they had jumped by over $1/bbl due to positive economic data from Europe and the possibility of new U.S. sanctions on Iran. Yesterday, these futures fluctuated within a range of approximately $1.50/bbl, dropping about $1.30 before ending the day down roughly 30 c/bbl.

Oil prices are being kept in check partly because the OPEC+ group has significant spare production capacity, with a good amount of geopolitical risk already factored into prices. Contributing to the stability are the signs of weakening in physical oil markets, attributed to peak refinery maintenance, increased supply from the United States, and a recovery in production from earlier outages, such as those in Libya. U.S. crude exports to Europe have increased in the first four months of 2024. Additionally, WTI Midland crude is available, which is the largest stream for the Brent benchmark.

The premium of Brent’s first-month contract over the six-month has dropped, suggesting reduced supply tightness. Meanwhile, the market for lighter, sweeter crude oils, which are less dense and have lower sulfur content, remains well-supplied. In contrast, heavier, sour crude oils are facing tighter supply due to OPEC+’s prolonged cuts and other developments, such as Mexico’s recent export reductions and the UAE’s shift to export more light Murban crude. OPEC+’s ample spare capacity, estimated at 6 Mbpd by the International Energy Agency, provides a buffer against potential supply disruptions, helping to moderate price reactions to shifts in supply and demand.

It is anticipated that the Biden administration will escalate sanctions on Iranian oil later this week, following approval from the U.S. House of Representatives over the weekend. This move comes in response to Iran’s recent attack on Israel. The new sanctions will likely focus on ships and refineries processing Iranian oil.

Concerns are surfacing that if tensions between Iran and Israel escalate to the point of closing the Strait of Hormuz, it would significantly disrupt the global oil market, causing an increase in crude oil prices. The Strait is a critical passage that currently handles about 20% of the world’s daily crude oil consumption, approximately 21 Mbpd. The possibility of finding alternative routes for this substantial volume of oil is nearly non-existent. This closure risk has loomed over the international oil market for years, heightened by Iran’s periodic threats to shut down the Strait, though it has never acted on these threats due to the potential self-harm of cutting off its own oil exports. While alternative pathways exist for oil from the UAE and Saudi Arabia via the Red Sea, the options for rerouting are limited, showing the importance of the Strait in global energy supply chains.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.