Natural Gas News – April 9, 2024

Natural Gas News – April 9, 2024

Natural Gas News: Resilient Performance Amid Bearish Factors

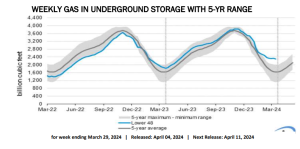

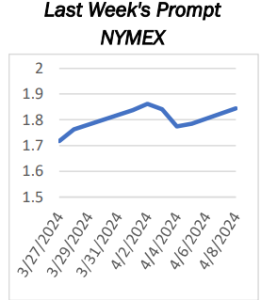

Natural gas futures are exhibiting minimal movement on Monday, indicating uncertainty amidst consolidation just above a significant long-term low. This price action reflects a blend of short-term weather demand outlook and a longer-term anticipation of production cuts leading to reduced stockpiles. At 12:48, Natural Gas Futures are trading $1.790, up $0.005 or +0.28%. Despite a myriad of bearish factors, the U.S. natural gas market showed resilience last week, with futures posting a modest uptick. The primary driver was the expectation of sustained low output in the coming weeks, attributed to ongoing declines in gas rig counts. Settlement for US Natural Gas futures stood at $1.785, marking a 1.25% increase. Notably, there was a significant decline in natural gas production, with average

output in the Lower 48… For more info go to https://tinyurl.com/yb5havn8

Massive Fuel Restrictions Underline Japan’s LNG Supply Vulnerability

Recent massive-scale fuel restrictions at JERA’s multiple thermal power plants in Tokyo Bay have underlined Japan’s vulnerability once again in facing LNG shortages in a short time period from a sharp demand increase and delays in ship arrivals. JERA, Japan’s largest power generation company, imposed rare massive-scale fuel restrictions affecting as much as nearly 7 GW of a gas-fired power generation capacity in Tokyo Bay over March 27-29, as the country’s

LNG inventory fell to the lowest level since January 2021. JERA’s fuel restrictions-led capacity outage rose to as much as 6.72 GW on March 29, from 4.98 GW on March 28 and 5.95 GW on March 27 as a result of weather and oceanic phenomenon, the company said in filings to the Hatsuden Joho Kokai System. JERA imposed the fuel

restrictions… For more info go to https://tinyurl.com/3zmemj9w

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.