Bullish Sentiment Fueled by Mexico’s Cuts and Brent Crude Surges

Bullish sentiment in the oil market is growing, and Brent crude has surpassed the $90 threshold, indicating a likely upward trend in oil prices for the week. Even the possibility of a ceasefire in Gaza hasn’t diminished the momentum. The decision by Mexico to reduce its oil exports is expected to further fuel bullish sentiment in the near term. Markets may also be influenced by upcoming inflation data from the US and China, which could even push prices toward the $95 mark. Despite this, oil futures closed lower on Monday, as traders took profits from recent advances, leading to a downturn in both crude oil and refined product contracts.

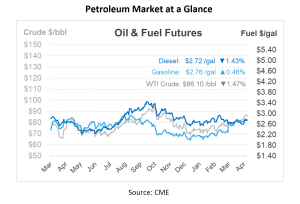

During yesterday’s trading, ULSD futures experienced the largest drop, with the NYMEX ULSD for May declining by over 4 cents, closing at $2.7287 per gallon, which was nearly 3 cents below the peak price of the session. The prices for June also saw a decrease, falling by 4 cents to $2.7217 per gallon. Meanwhile, the average price of regular unleaded gasoline in the U.S. has increased for six consecutive days, reaching a new peak for 2024 of $3.5978 per gallon on Monday. Diesel prices averaged at $4.0437 per gallon, showing a slight decrease from the previous day.

On the international front, WTI and Brent crude oil prices ended the day lower by approximately 50 cents and 80 cents per barrel, respectively. This decline came after Israel announced a reduction in its military presence in the Gaza Strip and reported advancements in ceasefire discussions. Israel’s Foreign Minister, Israel Katz, expressed optimism about the negotiations, suggesting a significant exchange of hostages could be possible, leading to a phased return of all involved. Following an agreement by OPEC to continue with supply cuts, Saudi Arabia raised its crude oil prices for May to its Asian customers, marking the second consecutive month of price increases for Asian-bound shipments.

In efforts towards achieving energy self-sufficiency, Mexico’s national energy company announced plans to reduce its crude oil exports by at least 330,000 bpd in May, which will result in a substantial supply decrease for the U.S., Europe, and Asia markets. This move is part of a broader strategy to divert more crude oil to domestic refineries, following a significant drawdown of Maya, Isthmus, and Olmeca crude this month. The decision to implement monthly export reductions comes in the wake of the country’s crude production dropping to its lowest level in 45 years as of February.

This article is part of Daily Market News & Insights

Tagged: 2024, Brent Crude Surges, Bullish Sentiment, Mexico’s Cuts

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.