Fuel Your Construction Fleet with Budget Confidence

Are you a project manager in a construction company, dealing with budget uncertainties and worrying daily about fuel price fluctuations? Have you considered the benefits of locking in a fixed price to keep your equipment fueled and running while enjoying peace of mind for the duration of your project? If so, then this article is for you!

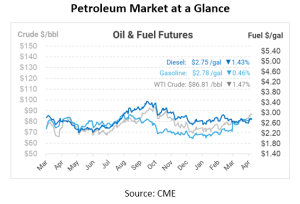

In the dynamic construction world, where projects can span months or even years, effective fuel management is crucial. Fuel prices are notorious for their volatility, fluctuating in response to geopolitical events, economic trends, and supply-demand dynamics. For construction companies, where project budgets must be meticulously planned, but profit margins can be variable, these fuel price oscillations pose a significant challenge. A sudden spike can throw budget projections off track, leading to financial strain or additional complexity.

In today’s article, we will explore fuel management strategies tailored to empower construction businesses, particularly focusing on mitigating price risks and enhancing budget security.

Addressing Budget Uncertainty

How can construction companies navigate fuel price uncertainties and secure their budgets for fuel purchases?

Price risk management emerges as a potent tool to address budget uncertainties around fuel buying. By purchasing fuel at a fixed price instead of at the daily market rate, construction companies can mitigate the risks associated with price fluctuations. A term fixed price agreement enables buyers to lock in fuel prices over the project’s duration, ensuring budget consistency regardless of market volatility.

Benefits of Price Risk Management

- Stability – Ensures predictable fuel costs, enhancing budget consistency

- Risk Mitigation – Shields against sudden price spikes, safeguarding the bottom line

- Budgeting – Facilitates effective budget planning and management

- Cash Flow – Improves cash flow management by eliminating uncertainties in fuel expenses

- Profit Margins – Enables construction companies to secure profit margins, enhancing financial stability

Case Study

A construction company heavily relies on diesel fuel to run its large fleet of vehicles and equipment. In the past, sudden jumps in fuel prices have hurt the company’s profits. To prevent this from happening again, the company decided to protect itself from future fuel price swings.

One big issue the company faced before was fuel prices increasing unexpectedly after they had already won a bid for a project. This forced them to spend more money than they had planned, which hurt their bottom line. Because the construction business operates with very narrow profit margins, even small changes in fuel prices would have a big impact.

To tackle this issue, the company decided to lock in a fixed price contract for its fuel purchases over their projects’ duration. This way, they knew exactly how much they would be paying for fuel, no matter what happened to market prices during the project. This helped to keep their costs under control and avoid any surprises that could hurt their finances.

Under the fixed-price contract, the company was not exposed to volatile fuel prices or to monthly usage commitments – but to a term consumption model. As long as the fuel was consumed over the life of the project, the price remained constant, providing stability and predictability in fuel expenses throughout the project duration, resulting in significant cost savings for the company.

In essence, effective fuel management goes beyond mere logistics—it’s about strategic foresight and proactive risk mitigation. By embracing price risk management tools, construction companies can navigate the volatile fuel market landscape with confidence, bidding for projects competitively while safeguarding their bottom line.

Plan for the Unexpected

With Mansfield Fuel Price Risk Management services, you can plan for the unexpected and mitigate the impact of these events on your bottom line. Protect your business against fuel price fluctuations and ensure cost stability, even in the face of unforeseen circumstances.

Our Price Risk Management experts will analyze your buying history and organizational goals to give you an analysis of your current fuel spending with a forecasted outlook and recommendations. Contact us today!

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.