Week in Review – April 5, 2024

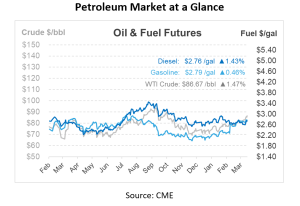

This morning, prompt crude futures are remaining around $86/bbl, after yesterday’s increases and are poised to conclude the week with an increase exceeding $3.50/bbl for a second weekly gain. Brent crude prices exceeded $91/bbl yesterday following widespread news coverage of escalating geopolitical tensions in the Middle East. This included comments from Israeli Prime Minister Netanyahu regarding conflicts with Iran and its allies. President Biden also called for a ceasefire in Gaza following the killing of aid workers in a missile strike earlier this week. The growing geopolitical unrest also led to a spike in crude market volatility, with the second-month WTI contract increasing by 2.37% to 28.1% yesterday—its highest point since late February.

In the broader financial markets, there was a downturn in equity values yesterday afternoon, with the S&P 500 index closing 1.2% lower. This marked the most significant drop in nearly two months, triggered by a series of hawkish statements from members of the Federal Reserve. Cleveland Fed President Loretta Mester remarked yesterday that more proof is required to confirm that inflation is on a downward trend, suggesting that rate decreases could be considered once such evidence is presented. Similarly, Minneapolis Fed President Neel Kashkari expressed reservations about reducing interest rates, noting that persistent inflation would lead to reconsidering the necessity of such rate cuts.

After enduring a prolonged yet mild downturn that began in mid-2022, U.S. manufacturing is coming out of a slump, signaling a positive outlook for petroleum consumption, particularly diesel and other middle distillates, in the coming months.

The services sector, which is considerably larger and has been more resilient, experienced a slight slowdown in March, surprising given its strong performance earlier in the year. Despite this, the U.S. economy as a whole continued to expand, achieving a better balance between the manufacturing and services sectors. This balance, alongside employment growth and persistent inflation, has led to revised expectations among traders regarding the pace of interest rate cuts by the Federal Reserve, now anticipating fewer reductions than previously expected.

The revival in manufacturing is expected to drive up demand for diesel. While distillate consumption slightly declined during the mild winter months, the recovery in manufacturing is expected to boost demand throughout the rest of 2024. Distillate inventories, although lower than the ten-year average, have remained stable, with logistical challenges such as drone and missile attacks on tankers having minimal impact on U.S. supply. Despite expectations to the contrary, the distillate market has maintained a comfortable supply level, reflected in the narrowing price gap between diesel and crude oil, suggesting a current ease in supply concerns.

Prices in Review

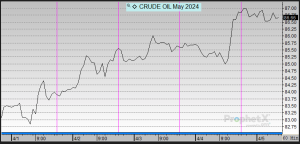

Crude oil opened the week at $83.14 and saw steady increases all week. This morning, crude opened at $86.86, an increase of $3.46 or 4.16%.

Diesel opened the week at $2.6215 and also saw increases throughout the week. This morning, diesel opened at $2.7553, an increase of 13 cents or 5.1%.

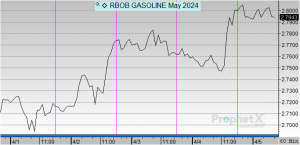

Gasoline opened the week at $2.7208, experienced increases until Thursday, and then reversed those losses on Friday morning. This morning, gasoline opened at $2.80, an increase of 8 cents or 2.98%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.