Natural Gas News – March 21, 2024

Natural Gas News – March 21, 2024

Natural Gas Slides Lower

Natural Gas prices (XNG/USD) trade subdued on Thursday after facing some profit-taking on Wednesday, with traders locking in some gains on long positions taken in the past few weeks. With the mixture of recent supply issues and delays in deliveries, European Gas reserves are not seeing the quick drain expected, urging traders to at least book some profit now. Meanwhile, LNG as an energy commodity is facing some pressure from European leaders, who are pushing for a renaissance in nuclear energy. Meanwhile, the US Dollar (USD) fell back below 104.00 and nearly all the way back to 103.00. The US Federal Reserve (Fed) was the main driver of the move by confirming via its dot plot that it still sees three rate cuts happening this year. This meant markets had to reprice their US Dollar positions again after investors ha… For more info go to https://tinyurl.com/mv64xk65

Natural Gas News: Prices Stabilize

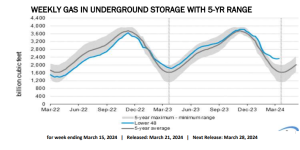

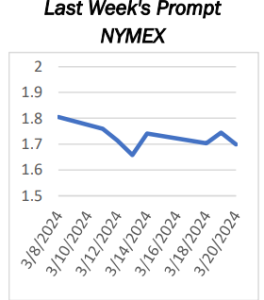

U.S. natural gas futures remained stable on Wednesday, following a notable increase the day before. This rise was spurred by colder weather forecasts and an anticipated surge in heating demand. At 12:34 GMT, US Natural Gas is trading $1.747, up $0.003 or +0.17%. Current weather patterns, characterized by colder temperatures in the northern U.S., are expected to drive moderate demand for natural gas over the next week. This shift comes after seven weeks

of substantially lower-than-normal demand. The increased need for heating due to cooler weather in the north and central U.S. through March’s end is set to intensify demand. However, this may be somewhat mitigated by a strong upcoming performance in wind energy generation. A key factor supporting futures is the continued decline in U.S. gas … For more info go to https://tinyurl.com/mvwuc6tp

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.