Natural Gas News – March 14, 2024

Natural Gas News – March 14, 2024

Natural Gas News: Bearish Outlook Prevails

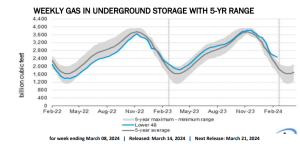

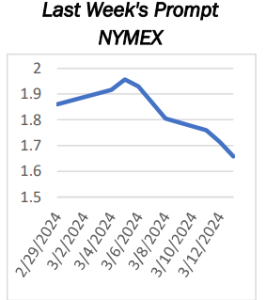

U.S. natural gas futures are experiencing a decline, influenced by various factors including weather forecasts, storage reports, and LNG plant outages. The market is poised for volatility in light of the upcoming Energy Information Administration (EIA) report and recent trends in gas prices and production. At 13:18 GMT, Natural Gas futures are trading $1.646, down $0.012 or -0.72%. The EIA storage report, scheduled for release today, is crucial in shaping market sentiment. Expectations point towards a draw of -3 to -6 Bcf, significantly less than the 5-year average of -87 Bcf. The report’s impact is heightened by the anticipation of whether recent trends in perceived lighter production will continue, potentially leading to a bullish outcome. The weather across most of the interior U.S. is expected to be mild until… For more info go to https://tinyurl.com/4verm5hc

Henry Hub Spot Gas Hits Lowest

Cash natural gas prices at the US benchmark Henry Hub sank to their lowest since the early 1990s in March 13 trading as mild weather and rising inventory levels keep the Gulf Coast market oversupplied. In mid-session trading, next-day gas prices at the Henry Hub were moving around $1.24/MMBtu, with even lower prices recorded at other Gulf Coast hub stretching from the Florida panhandle to the shores of South Texas, data from Intercontinental

Exchange showed. According to historical data from S&P Global Commodity Insights, cash prices at most Gulf Coast hubs March 13 were trading near lows last seen in the early 1990s. At the Henry Hub, prices were even lower than those recorded in 2020 when the global coronavirus pandemic fueled a fallout in US and international commodity prices. Across… For more info go to https://tinyurl.com/y3x6s9b2

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.