Natural Gas News – March 5, 2024

Natural Gas News – March 5, 2024

Natural Gas News: Mixed Performance Post

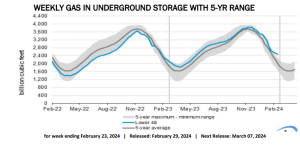

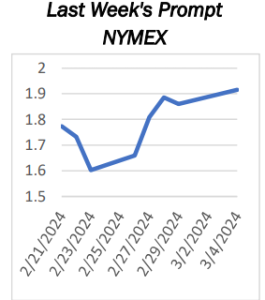

U.S. natural gas futures are putting in a mixed performance on Tuesday after a recent surge to their highest point since early February. The spike in prices came as a reaction to major producers cutting output due to low prices caused by a warmer-than-expected winter and unprecedented U.S. production levels. At 12:26 GMT, natural gas futures are trading $1.895, down $0.021 or -1.10%. EQT, a significant Appalachian drilling company, reduced its output by 1 billion cubic feet per day in late February, a cut that represents about 15% of its total production. This reduction is set to continue throughout March, with a re-evaluation planned thereafter. This move followed a similar strategy by Chesapeake, another key player in the industry. Since February 20, when natural gas prices were at their

lowest in decades when a… For more info go to https://tinyurl.com/5emn2bz7

Natural Gas Faces Headwinds With Summer

Natural Gas (XNG/USD) completely drops the ball and sinks in red numbers for this Tuesday. The premature winning streak ends quite quickly with traders selling near term contracts as further dated contracts are selling off even harder. Biggest reason is the abscence of European demand in the market where apparently demand to refuel the gas stockpiles is even more disappointing as first anticipated. Meanwhile, the US Dollar (USD) is gearing up for the first of many eventful days this week. Today, the so-called Super Tuesday takes place in the presidential primary election. The second big event will take place on Thursday, with the European Central Bank (ECB) monetary policy decision as a litmus test for the US Federal Reserve meeting on March 20. Ahead of Super Tuesday Primaries…For more info go to https://tinyurl.com/3ananhv3

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.