Natural Gas News – February 8, 2024

Natural Gas News – February 8, 2024

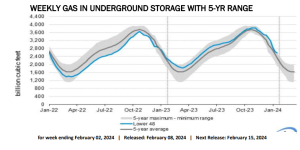

Natural Gas: Ugly Price Action

On January 9, 2024, in a Barchart article that asked if U.S. natural gas futures can continue to rally in 2024, I wrote: Natural gas is going into 2024 in the same bearish trend since the August 2022 high. However, the price had declined to a level that favored the upside in 2024, causing a seasonal rally to over $3.20 per MMBtu in early January. The weather over the coming weeks will dictate the energy commodity’s path of least resistance. The rally took U.S. NYMEX March natural gas futures prices to a $2.791 per MMBtu high on January 9, while the continuous contract rose to $3.392 per MMBtu. Natural gas futures failed to follow through on the upside and were approaching a test of the $2 level on February 7. NYMEX U.S. natural gas futures for March delivery at the Henry Hub in Erath, Louisiana,

have been in a… For more info go to http://tinyurl.com/3ux4vwcu

Natural Gas Sinks With Manchin Calling

Natural Gas (XNG/USD) is eking out more losses sub-$2, after calls from Senator Joe Manchin at the start of the second day of hearings to scrub the LNG export ban. The House Committee is probing the US President Joe Biden’s halt on any developments of new LNG export terminals. The administration had said it would not issue approvals

on new studies and plans earlier than after one year. The probe will be heading into its second day this Thursday with a hearing on the issue with Deputy Secretary of Energy David Turk. The US Dollar (USD), which is negatively correlated to Natural Gas, is steady after some profit taking from its earlier peak performance on Monday and

past Friday. The geopolitical element helps the Greenback a bit with Israel Prime Minister Benjamin Netanyahu rejecting the… For more info go to http://tinyurl.com/9ujdzyyh

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.