Oil and Gas Industry Survey: Uncertainties Ahead?

The final quarter of 2023 has brought mixed news for the oil and gas industry, as revealed in a recent survey conducted by the Dallas Federal Reserve Bank. The survey, which gathered insights from oil and gas executives, paints a picture of a sector grappling with uncertainty while facing some notable changes in its landscape.

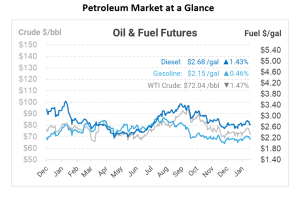

The survey findings indicate that oil and gas activity remained relatively stable in the final closing of 2023. However, optimism within the industry seems to be on the decline as uncertainty takes center stage. According to Kunal Patel, the Bank’s economist, it can be linked to lower average oil prices and questions surrounding OPEC’s ability to influence those prices.

One of the most striking findings is the shift in outlook for Exploration and Production (E&P) firms. The company outlook index for these firms plummeted from 46.8 to -9.0. This sharp decline indicates a significant change in sentiment among E&P executives.

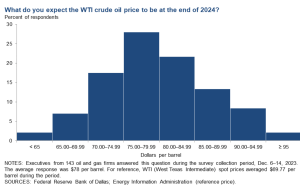

When asked about their expectations for WTI crude prices at the end of 2024, 28% of the executives anticipated prices to settle in the range of $75 to $79.99 per barrel. These predictions reflect the cautious optimism prevailing within the industry.

It is important to recognize that the increase in production from new wells has exceeded expectations. However, this growth is primarily attributed to higher output from specific sites rather than an escalation in the number of wells. Consequently, total US crude oil production reached a record high in the last week of the year, standing at 13.3 million barrels per day.

While industry activity remains steady, uncertainty looms large, and executives are adjusting their strategies accordingly. With differing goals for 2024 and geopolitical tensions on the horizon, the industry faces a complex and dynamic future. It will be essential for companies to adapt and innovate to thrive in this changing environment.

This article is part of Daily Market News & Insights

Tagged: oil and gas industry, Survey

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.