Week in Review – February 2, 2024

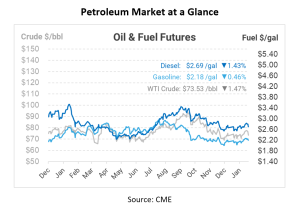

Oil prices experienced a week marked by significant fluctuations. Initially, there was a notable surge, particularly in the case of Brent crude, which approached $85 per barrel on Monday. However, as the week unfolded, this initial enthusiasm waned, resulting in Brent opening this morning at $78.45 per barrel and U.S. West Texas Intermediate (WTI) at $73.53.

These price swings can be attributed to a combination of factors. The decision by OPEC+ to maintain their current production policy played an important role, sending waves across the oil market. Additionally, broader concerns came into play, including uncertainties regarding China’s economic growth, the geopolitical tensions in the Middle East, and the nuanced signals emanating from the U.S. Federal Reserve regarding monetary policy.

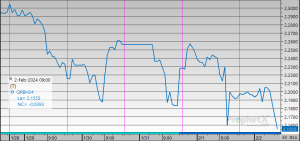

The graphic below highlights a moment when diesel prices took a sudden drop in prices on Thursday. It provides a glimpse into the significant market shifts currently impacting the industry.

One of the main factors influencing these price fluctuations is the decision by OPEC+ to maintain its existing production policy. This decision, which came as a surprise to some, signaled a commitment to maintaining the status quo for the time being. OPEC+ has held onto output cuts of 2.2 million barrels per day (bpd) for the first quarter of the year, a decision made back in November. Market observers and analysts had been eagerly awaiting news of a potential shift in policy, but the group chose to defer any revisions until March.

Another noteworthy development was the US Federal Reserve’s stance on monetary policy. The Federal Reserve opted to keep benchmark interest rates steady within the 5.25-5.50% range. Fed Chair Jerome Powell’s subsequent comments that interest rates had peaked and would gradually decrease in the months ahead were interpreted positively by the market. This outlook provided support to oil prices, as lower interest rates can stimulate economic growth and, in turn, increase oil demand by reducing consumer borrowing costs.

However, these factors were not the only drivers of oil price fluctuations during the week. Geopolitical tensions in the Middle East keep adding elements of uncertainty to the market. Unverified reports of a ceasefire agreement between Israel and Hamas led to a sudden drop in oil prices, with a more than 2% decline recorded on Thursday. The situation remains fluid, with mediators awaiting a response from Hamas regarding a ceasefire proposal. A potential ceasefire could alleviate concerns over political risks that could disrupt vital Gulf and Red Sea shipping lanes, crucial for global energy flows.

Additionally, ongoing concerns regarding China’s economic recovery weighed on market sentiment. The International Monetary Fund (IMF) had recently forecasted a slowdown in China’s economic growth, projecting a decline to 4.6% in 2024, followed by further deterioration to approximately 3.5% by 2028. China plays a pivotal role in global oil demand, and these projections contributed to market unease.

In parallel, OPEC’s efforts to stabilize oil markets were in the spotlight. The organization implemented a production cut last month, aimed at mitigating potential oversupply issues and providing support to oil prices. However, this move faced challenges, with disruptions in Libya accounting for a portion of the output decline. Moreover, countries such as Iraq and the United Arab Emirates exceeded their production quotas, underscoring the complexities of coordinating output among OPEC members and their allies.

Prices in Reviews

WTI Crude opened Monday at $77.07, and the prices increased slightly on Tuesday to $77.57. However, the trend reversed as the week progressed. By Wednesday, the price dropped to $76.73, followed by a further decrease to $76.40 on Thursday. This morning, crude opened at $76.36, a decrease of $0.71 or 0.92%.

On Monday, Diesel opened the week at $2.8327, and it slightly dropped to $2.7934 on Tuesday. By Wednesday, it saw a slight increase to $2.8215, but from Wednesday to Friday, the price steadily declined, opening at $2.6775 on Friday. This represents a price decrease of $0.1552, or approximately 5.48%.

Gasoline opened the week at $2.2447. Tuesday saw a slight decrease to $2.2194, followed by a modest increase to $2.2295 on Wednesday. However, the downward trend resumed, with Thursday’s price at $2.2204 and Friday’s price hitting $2.1555 per gallon, representing a decrease of $0.0892 or 3.97%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.