Natural Gas News – December 19, 2023

Natural Gas News – December 19, 2023

LNG Demand Recovery to Support Rated Producers’ Credits

Fitch Ratings-Sydney-18 December 2023: Fitch Ratings expects APAC liquefied natural gas (LNG) demand to continue rising gradually, driven by the region’s economic recovery and new re-gasification facilities coming online. Medium-term demand will be further supported by the south and south-east Asian markets, with domestic production not keeping up with demand growth. The demand recovery is likely to support the credit profiles of Australian LNG producers despite their large investment plans. The US, the main contributor to the increased supply in 2023, will firm up its market positions over the next few years when around 25 million tonnes per annum of new LNG capacities come online. New liquefaction capacities are also becoming operational in Canada and Mexico, making more LNG available to the APAC region. Neverth… For more information, go to https://shorturl.at/acoHY

Record-High U.S. Production Weighs on Natural Gas Prices

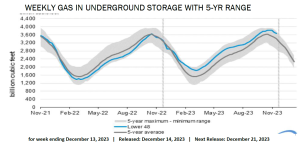

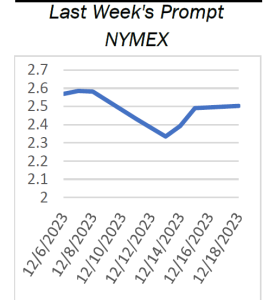

Natural gas futures are poised to open lower on Wednesday, influenced by bearish factors such as the latest EIA outlook report and forecasts for warmer US temperatures. January futures are currently trading at $2.292, reflecting a decrease. The US is set to experience milder temperatures, particularly in the southern regions, leading to a very light demand for natural gas in the next seven days, according to NatGasWeather.com. Over the next two weeks, warmer-than-normal temperatures are expected across most of the US, reducing heating demand significantly. This weather outlook, coupled with the EIA’s prediction of record high US natural gas output, is exerting downward pressure on prices. The market is responding to these developments with natural gas futures hovering just above

$2.30 per … For more information, go to https://shorturl.at/ikJ49

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.