Week in Review – December 15, 2023

The International Energy Agency (IEA) has updated its forecast for global petroleum demand in 2024, now expecting an increase of 1.1 million bpd, which is 130,000 bpd higher than its earlier prediction. This optimistic revision primarily reflects an improved demand outlook from the United States. Coinciding with the IEA’s positive forecast and a weakening U.S. dollar, there has been a rise in oil prices. For the first time in two months, the oil market experienced a price surge, a reversal from the recent downtrend influenced by geopolitical uncertainties.

In a contrasting view, the Organization of the Petroleum Exporting Countries (OPEC) projects a much larger demand increase of 2.25 million bpd for 2024. This difference in forecasts underscores the ongoing uncertainty in the oil market, with the IEA adopting a more cautious stance compared to OPEC’s more bullish outlook. Concerns of oversupply still caution the market as these key organizations disagree on future outlooks.

Further influencing oil markets, the U.S. dollar index dropped by 0.9%, following remarks from Federal Reserve Chair Jerome Powell that suggested the possibility of interest rate reductions in 2024. This weakening of the dollar typically makes oil, which is traded in U.S. dollars, more appealing to investors holding other currencies.

Adding to the diverse perspectives, the U.S. Energy Information Administration (EIA) has adjusted its 2024 forecast for Brent crude oil to $83 per barrel, presenting a more moderate view of future oil prices. This range of forecasts—from the conservative IEA estimate to OPEC’s optimistic projection, along with the EIA’s balanced outlook—highlights the varying expectations and potential volatility in the oil market as it navigates through diverse economic and geopolitical influences.

Last week, U.S. commercial crude oil stocks (excluding the Strategic Petroleum Reserve) saw a decrease of 4.3 million barrels. Currently, at 440.8 million barrels, these inventories are approximately 2% lower than the five-year average for this period. In contrast, total motor gasoline inventories rose by 0.4 million barrels and are also around 2% below the five-year average for this time of year. There was a decline in finished gasoline stocks, but an increase in blending components inventories was observed. Distillate fuel inventories, which include diesel, rose by 1.5 million barrels, yet they remain about 12% under the five-year average for this season. Overall, total commercial petroleum inventories witnessed a substantial decrease of 10 million barrels last week.

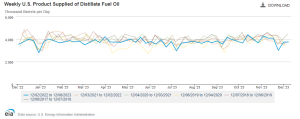

The days of supply for diesel fuel surpassed the 30-day mark for the first time since mid-September, showing an increase of two full days within a single week. If this trend continues, it could help stabilize prices. However, the risk of a price surge, particularly along the East Coast, remains possible, potentially linked to a severe cold wave in the Northeast.

The rise in diesel supply days may be attributed to a decrease in demand. The chart below demonstrates “implied demand,” which estimates the amount of product supplied to the market in the absence of real-time demand data from the EIA. During the Thanksgiving week, there was a strong drop in this metric, even compared to the same period in previous years. This change might be a temporary anomaly or an indicator of a more substantial shift in demand patterns.

Prices in Review

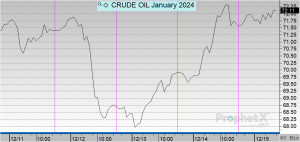

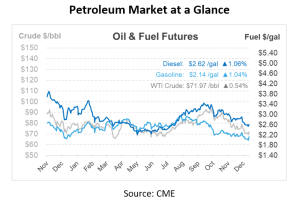

Crude opened the week at $71.15 and saw moderate up-and-down swings throughout the week. This morning, crude opened at $71.61, an increase of 46 cents or 0.646%.

Diesel opened the week at $2.58, and also saw moderate up and down swings throughout the week. This morning, diesel opened at $2.5974, an increase of one cent or 0.674%.

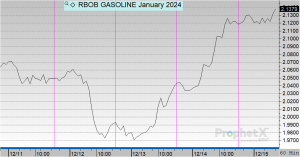

On Monday, gasoline opened at $2.0455, rose slightly on Tuesday, and dropped Wednesday before showing mild gains for the remainder of the week. This morning, gasoline opened at $2.1247, an increase of nearly 8 cents or 3.87%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.