Canada’s Trans Mountain Pipeline Expansion Nears Completion

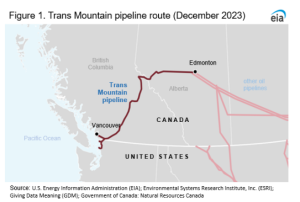

Canada’s Trans Mountain Pipeline expansion project is on the edge of completion. According to the U.S. Energy Information Administration (EIA), over 95% of the construction is finished and expected to be launched early next year. This development marks a significant milestone for Canada’s energy infrastructure, particularly in the realm of crude oil transportation. The project, which aims to triple the existing pipeline’s capacity, has far-reaching implications for Canada’s crude oil industry and its global market presence.

The Trans Mountain Pipeline expansion is set to increase the pipeline’s capacity from 300,000 barrels per day (b/d) to an impressive 890,000 b/d. In 2018, the Canadian government acquired the pipeline from Kinder Morgan, establishing the Trans Mountain Corporation (TMC) to oversee the expansion. However, the project has faced substantial challenges, including legal battles with environmental activists and Canadian First Nations groups.

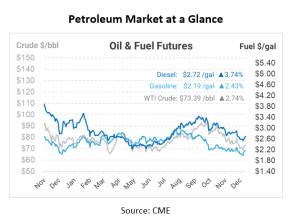

One of the most significant outcomes of the early activation of the pipeline expansion is the anticipated narrowing of the price gap between West Canada Select (WCS) and West Texas Intermediate (WTI) crude oils. This price differential reflects not only variations in oil quality but also the logistical constraints faced by sellers in western Canada. As the pipeline becomes more accessible for shipping Canadian heavy crude to Asia or the U.S. West Coast, it’s likely to intensify competition among buyers, potentially leading to higher relative prices. It’s important to note that the refining of heavy grades still requires advanced refinery facilities, which will continue to be in demand.

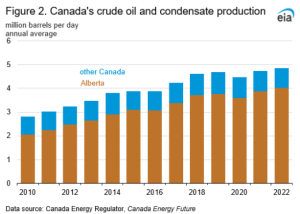

Canada’s Crude Oil Production Landscape

Canada’s crude oil production landscape has witnessed consistent growth over the past several years, with Alberta playing a central role in this expansion. In 2022, Alberta accounted for a substantial 82.7% of Canada’s total crude oil production, a significant increase from 2012. The primary source of this production is the bituminous oil sands in northeastern Alberta, known for their heavy-grade crude oil. The benchmark for assessing heavy crude oil prices in the region is WCS, priced at Hardisty, Alberta.

Exporting Canadian crude oil to global markets, however, remains challenging. Unlike WTI, WCS exports are constrained by a lack of infrastructure for alternative destinations outside of the United States or Canada. The majority of Canada’s crude oil is exported to the United States, primarily to refineries in the Midwest and the Gulf Coast. Limited access to waterborne markets has resulted in costly rail shipments for Canadian crude oil.

The Trans Mountain Pipeline’s successful launch will represent a pivotal moment for Canada’s crude oil industry, offering increased access to global markets and potentially altering pricing dynamics. However, challenges remain, emphasizing the need for continued diligence and commitment to ensure the expansion’s success.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.