Influences of International Events and World Bank Predictions on the Global Oil Market

Prompt crude futures are up over 50 c/bbl this morning after settling on Monday at levels not seen since before the Israel-Hamas conflict erupted earlier this month, resulting in decreased diesel and gasoline contracts. Several large refineries are expected to return from extended maintenance in the coming weeks, bringing additional gasoline to markets.

The United Nations has expressed concern over the conflict in the Middle East spilling into Syria, describing the country as “at its most dangerous for a long time” following repeated Israeli airstrikes. China has also been in the spotlight, with manufacturing activity unexpectedly contracting in October. This, along with the global impact of the Middle Eastern conflict on crude supply, has sent crude prices lower. Both Brent and WTI crude witnessed a drop of over $3/bbl yesterday due to geopolitical risk, lower fuel margins, and weaker cash prices.

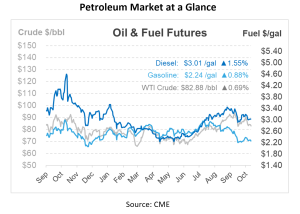

Warnings from the World Bank that oil prices could skyrocket to between $100 and $150/bbl if the Middle Eastern conflict escalates are weighing heavy on markets. According to the bank, even a minor disruption in crude supplies could remove between 500,000 and 2 million bpd from global markets, potentially driving prices to between $93 and $102/bbl. If the conflict expands, we could see a medium-sized disruption of 3 to 5 million bpd, pushing prices as high as $121/bbl. In a worst-case scenario, a disruption of 6 to 8 million barrels per day could see prices reaching $157 per barrel. According to the bank’s primary forecast for this quarter, oil prices are expected to average $90/bbl followed by a decrease to an average of $81/bbl in the next year due to a slower global economy. Additionally, a 4.1% drop in overall commodity prices is expected for the next year, with stabilization not expected until 2025.

Fortunately, the impact of the Israel-Hamas war on the oil market has been minimal. Oil processing in Russia reached a seven-week peak as the country’s refineries wrap up their seasonal maintenance. In the week ending October 25, Russia processed an average of 5.48 million bpd, which is an increase of almost 210,000 bpd compared to the previous week. Refinery operations ramping back up has raised Russia’s average daily processing to 5.31 million barrels over the month of October, although this figure is still slightly below the September average of 5.38 million bpd, as per the calculations.

In Venezuela, political unrest continues to unfold as a federal court suspended an opposition party’s primary election vote. China’s crude throughput is predicted to decrease in October from the record high in September, driven by maintenance, weakening domestic demand, and rising stockpiles.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.