Natural Gas News – September 14, 2023

Natural Gas News – September 14, 2023

Natural Gas Prices Forecast: NatGas Landscape Rides on Weather

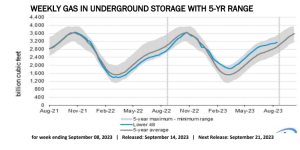

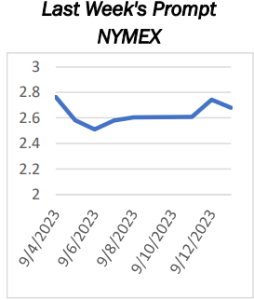

US natural gas futures have experienced volatility in recent days, with a surge on Thursday ahead of the Energy Information Administration’s (EIA) weekly storage report. The EIA will release its weekly storage report at 14:30 GMT. However, this follows a 2% slide the previous day due to anticipated milder weather and a reduced demand outlook. This demand drop was partially attributed to a decline in gas flowing to LNG export plants, particularly from the Freeport LNG plant in Texas. During the week-ending September 8, US utilities added a below-average 48 billion cubic feet (bcf) of natural gas to storage, driven by a hotter-than-average weather that spurred power generators to burn more fuel. This storage addition was notably less than the same week in the previous year and the five-year average. Early estimates …

China’s LNG Buying Spree Threatens Global Gas Market Stability

China is back on the spot LNG market to seek cargoes for the coming winter, potentially upsetting a fragile balance in the global natural gas market just as Europe has reached its gas storage target well ahead of the November 1 deadline. Following a record slump in Chinese gas demand and LNG imports last year prompted by Covid-related lockdowns, China’s gas consumption has risen so far this year compared to 2022, although it’s still below the growth seen up to 2021. In recent months, China has signed a lot of long-term LNG supply deals, including with the top exporters, the United States and Qatar. But China is also back on the spot market with a massive tender for cargoes to be delivered later this year and throughout 2024. Intensified competition from China and other Asian buyers could l…

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.