Natural Gas News – August 10, 2023

Natural Gas News – August 10, 2023

US Nat Gas Edges Up As Hot Weather Forecasts Offset Higher Output

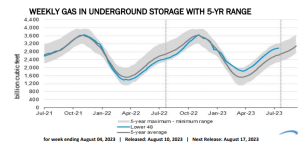

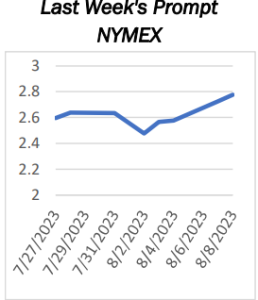

U.S. natural gas futures edged higher on Tuesday as hotter than normal weather kept air conditioning demand high, especially in Texas, offsetting pressure from rising output. Front-month gas futures for September delivery on the New York Mercantile Exchange were up 1.9 cents, or 0.7%, to $2.74 per million British thermal units (mmBtu) at 10:07 a.m. EDT (1407 GMT). Warmer than normal temperatures in the densely populated states, continued heat in Texas, and indications that LNG export facilities are ramping up in anticipation of higher winter demand – are all providing a more stable and supportive market for prices, said Gary Cunningham, director of market research at Tradition Energy. “Especially when you layer on the fact that we’re seeing drilling CapEx cutbacks by several natural gas major players, we expect …

Govt To Sign 15-Year LNG Import Deals With US Excelerate, Summit

The cabinet committee on economic affairs in a meeting on Wednesday agreed in principle with two proposals from state-owned Petrobangla to sign long-term deals with two companies for importing liquefied natural gas. The companies are Excelerate Energy Bangladesh Ltd, a subsidiary of US-based Excelerate Energy, and Summit Oil and Shipping Co Ltd, a Dhaka-based public limited company of the Summit Group.The meeting presided over by finance minister AHM Mustafa Kamal agreed in principle to sign contacts with the companies for 15 years, said Md Amin Ul Ahsan, an additional secretary of the cabinet division, at an online briefing. The companies will start supplying LNG from 2026, he said.he officials also said the Petrobangla was planning to import 1 to 1.5 million tonnes of LNG per annum to be…

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.