Looking Ahead: From Bullish July to August Uncertainty

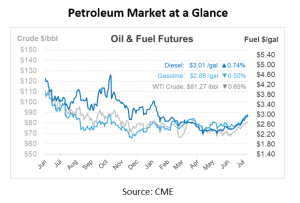

July 2023 proved to be a bullish month, with crude oil benchmarks soaring about 17% higher than pre-Independence Day figures. Moving into August, the bullish run may come to a close. Over the course of July, diesel also saw significant gains, pushing wholesale prices past the $3/gal threshold in some cases and seeing a resurgence of retail prices surpassing $4/gal.

This morning, crude futures traded down by 30c/bbl. This dip also coincided with lower equity futures, alongside a strengthening dollar ahead of the release of the June Job Openings and Labor Turnover (JOLTS) report. Despite this slight deceleration, the crude rally of yesterday carried WTI and Brent higher by $1.30/bbl and $1/bbl, respectively. Crude prices ended July with gains above 15%, the largest monthly rise since early 2022. Crude is currently flirting with its highest levels year-to-date, with WTI hovering just $2/bbl below its April peak and Brent roughly $1.10/bbl under its January peak.

Shifting the focus eastwards, Russian crude oil imports to India are dwindling as prices rise and Russia complies more rigorously with its pledged OPEC production cutbacks. The decrease reflects Russia’s commitment to slash crude exports by 500k bbl/d. The decreasing trend is also credited to Indian refiners’ hesitation in crossing the price cap on Russian crude imposed by Western nations. Russia’s Ural crude rose by 16.4% in July to $64.37/bbl, exceeding the G-7 price cap set at $60/bbl. Predictions indicate a continued fall in imports, potentially touching as low as 1.6 mmbbl/d in August, marking the lowest monthly level this year. These moves could push India to seek importing from other suppliers.

Meanwhile, Alberta’s oil-sands production, which is still reeling from the effects of the wildfire, continues to dwindle. The total output from this Canadian region has slumped to its lowest since 2016. A sizable 21% MoM drop in Alberta’s total output, with oil-sands mine falling by a steep 48% MoM, highlights the ongoing struggle for recovery from the wildfires that resulted in nearly 1 mmbbl/d of production shutdown at their peak. In stark contrast, Texas oil production, contributing around 40% of the US output, escalated to a commendable 5.49 mmbbl/d in May, marking the highest production since 1981.

Looking into next month, apprehensions about gasoline futures are heightened due to the planned refinery turnarounds in the Northeast. It’s been reported that at least one Pennsylvania refinery will produce virtually no gasoline or diesel from mid-September through mid-October. To add to the concerns, sources have recently reported a similar downtime for another large refinery in the Canadian Maritimes. The looming question is how these turnarounds will affect gasoline futures and the larger petroleum industry.

This article is part of Daily Market News & Insights

Tagged: 2023 oil prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.