Rising Crude Futures and the Global Gasoline Demand Puzzle

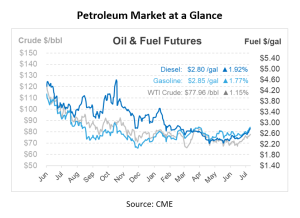

Crude futures are up 50c/bbl this morning while equity futures and the US dollar are only experiencing marginal gains. The week ahead is shaping up as a busy one with 150 S&P companies set to announce their earnings and the FOMC meeting on Wednesday, which is expected to result in an additional 25 basis points rate hike, according to Goldman Sachs.

Last week, petroleum markets saw a fourth consecutive week of oil price growth. WTI closed $1.40/bbl higher and Brent followed suit, closing at $1/bbl higher due to the tightening of the crude and distillate markets.

As we look towards the global gasoline complex, there is an apparent shortage of inventory. This, combined with limited refining capacities outside China and Russia, could result in future supply challenges. The potential for unplanned refinery outages in the US Gulf Coast adds to this uncertainty, posing a risk of surging gasoline cracks.

In a recent discourse, Goldman Sachs shed light on the future of oil and gas investing, projecting a promising growth in capital expenditure (capex) in the coming half-decade. This resurgence in energy investment is driven by three critical factors: the Russia-Ukraine conflict lending a new sense of urgency, increased profitability of new investments, and the consistent recovery in demand post-Covid. Consequently, Goldman Sachs forecasts a robust annual capex growth in the energy sector, around 10%, for the next five years.

Nevertheless, the United States is facing a challenging transition. While gasoline demand is unlikely to reach the pre-pandemic peaks observed in 2018/19, the rate of its decline remains ambiguous. This poses a significant challenge for the industry and government as they strategize for a low-carbon economy. Planning the right level of investment to keep up with existing petroleum demand, while laying the foundation for new technologies, is a difficult challenge.

The Energy Information Administration (EIA), facing the complexity of predicting gasoline demand, has revised its forecast multiple times this year. According to the EIA, U.S. gasoline consumption most likely peaked at around 9.33 million bpd in 2018. Since then, the post-pandemic transition to a hybrid work model and improved vehicle efficiency have reduced fuel demand for commuting. Despite this, the number of vehicles on the road has never been higher, with a record number of gas-consuming vehicles, such as pickups and truck SUVs, being sold. With American motorists consuming 9% of the world’s oil, the trajectory of U.S. gasoline demand is crucial for determining global fuel prices.

During the pandemic, many oil companies predicted that demand would never recover, leading to refinery closures. As per the EIA data, six refineries were either shut down or converted to biofuels production from 2020 to 2021, resulting in the removal of 750,000 bpd of capacity. In response to lower domestic demand, some refiners are tapping into international markets, exporting a record 323 million barrels of gasoline last year. Depending on the transition’s pace, the U.S. could lose up to 2 million bpd or over 10% of its refining capacity in the next 5-10 years.

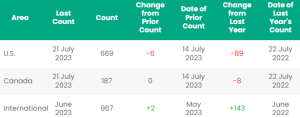

On the production side, the U.S. crude oil rig count has fallen to a new low, marking a 15% decrease from the highs of 2022. The primary contributors to this drop were the Permian, Eagle Ford, Granite Wash, and “Other” sectors. This downward trend reveals a continued decrease in activity in the Permian and other basins, a vital insight for investors and stakeholders in the petroleum industry. As of the week ending July 21st, the U.S. crude oil rig count stands at 530, lower by 16 rigs month-over-month and 69 rigs year-over-year.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.