Week in Review – July 21, 2023

Oil futures saw an upward trend today, with prompt prices rising by $1 per barrel, further building on gains from yesterday. The boost in equity futures and a stronger dollar, coupled with lower rates after a robust rally, have contributed to the positive sentiment in the market.

The recent performance of major stock indices indicates a mixed picture. The S&P closed down 0.68% yesterday, while the DJIA closed up 0.47%. However, both indices are on track to close higher for the week.

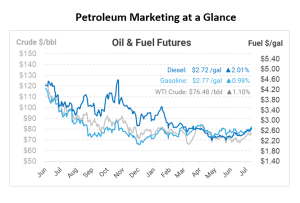

Oil prices settled higher on Thursday due to lower US crude inventories and robust crude imports by China, even though a cautious demand outlook kept investors on alert. Brent and WTI crude futures both saw modest gains, with Brent settling at $79.64 per barrel and WTI settling at $75.63 per barrel for the August contract. The September WTI crude contract settled at $75.65 per barrel.

Despite strong economic data and low employment rates, concerns about inflation and a potential rate hike by the Federal Reserve have impacted oil demand projections. The Fed is expected to raise its benchmark overnight interest rate by 25 basis points to the 5.25%-5.50% range next week for the last time in this rate-tightening cycle.

Global Investment Research (GIR) has released two macro pieces, focusing on the depreciation of the US dollar and the upcoming July FOMC meeting. GIR projects that the Federal Reserve will raise rates by 25 basis points for the last hike in this cycle. The outlook for the dollar’s depreciation is characterized as “shallow,” with GIR citing reasons such as sticky inflation forecasts and expectations of easing policies in other parts of the world.

Regarding the FOMC meeting, a 25 basis point rate hike is fully expected, with GIR forecasting this to be the last hike of the cycle. GIR holds more hawkish views than market pricing, anticipating rate cuts to start in 2024Q2 and proceed gradually at 25 basis points per quarter, eventually reaching a funds rate of 3-3.25%.

As the market navigates mixed global demand outlooks, Citi analysts noted that Brent crude prices have broken through to a higher range, supported by Saudi output cuts and geopolitical risks. However, the outlook remains cautious, with demand showing variations across different sectors.

An important development in the oil industry comes from Russia, which effectively halted its practice of ship-to-ship transfers of crude in July due to recent cuts. The reduction in such transfers has been influenced by cost considerations, as well as increased regulatory scrutiny following the European Union’s ban on ships involved in such operations with Russian oil.

In response to China’s growing oil imports, the US Senate has overwhelmingly passed an amendment to ban exports of oil from the Strategic Petroleum Reserve to China. The bipartisan sentiment reflects the desire to address competition with China’s communist government, with lawmakers concerned about national security implications.

In another significant development, the Biden administration has proposed a substantial increase in bonding rates to cover the costs of plugging abandoned oil and gas wells on federal lands. The proposed measure aims to increase the bonding rate for a single lease by 15 times, indicating a strong move towards environmental protection.

Overall, oil markets continue to experience fluctuations driven by economic factors and geopolitical developments, with investors keeping a close eye on the Federal Reserve’s decisions and global demand projections.

Prices in Review

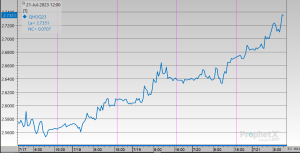

Crude opened on Monday at $74.80, went down on Tuesday, and increased again at the end of the week. This morning, crude opened at $76.48, an increase of over $2 or 1.68%.

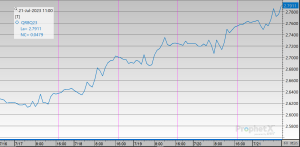

Diesel opened on Monday at $2.58 and saw some gains during the week. This morning, diesel opened at $2.71, an increase of 13 cents or 5.04%.

Gasoline opened on Monday at $2.62 and kept increasing throughout the week. This morning, diesel opened at $2.79, an increase of 17 cents or 6.49%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.