Week in Review – June 23, 2023

In the spotlight this week, oil futures dropped by 80c/bbl, adding to the retreat from yesterday’s session. After Federal Reserve Chair Powell and other central banks hinted at raising interest rates, the value of stocks for the future fell, and the U.S. dollar became more expensive. Also, inflation is becoming a concern again.

However, the economic scales tell a different story. The US economy showed its strength with encouraging reports on Initial Jobless Claims and existing home sales, likely guiding the S&P to an optimistic close. The oil market, on the other hand, suffered a loss of over $3/bbl yesterday as it continues to grapple with the Fed’s insistence on more hikes, despite a higher-than-expected crude draw reported by the EIA last week. As we head towards the end of June, oil appears set to conclude this short trading week down by $3.3/bbl, maintaining a flat position from last week.

On the geopolitical front, the European Union has launched its 11th sanction round since the Ukraine conflict began, aiming to stifle Russian oil exports and curb their energy revenue. Meanwhile, oil prices came under pressure on Monday due to doubts over China’s economic growth, despite OPEC+ output cuts and the US’s seventh consecutive drop in operating oil and gas rigs.

All signs pointing to an unsteady economy, the United States Oil Fund ETF had a major cash outflow. In fact, it saw its biggest 2-day cash pullout since last December. With a $0.48 drop, Brent crude settled at $76.13 a barrel, and US West Texas Intermediate crude fell by $0.49 cents to $71.29.

Major banks have started to dial back their 2023 GDP growth expectations for China after last week’s data revealed signs of stumbling in the post-COVID recovery of the world’s second-largest economy. Yet, the global economy has its eyes on China, hoping to see positive signals from their economic performance in the latter half of this year and the effectiveness of their recent stimulus measures.

Interestingly, despite U.S. sanctions, Iran’s crude exports and oil output have increased to new highs in 2023, adding to global supply at a time when other producers are pulling the reins on their output. On the other hand, OPEC and allies, including Russia, have agreed on a new oil output deal with Saudi Arabia, committing to a significant reduction in its output for July.

This past Thursday, the EIA reported a 3.8 mmbbls crude draw for the week ending June 16th, while gasoline and distillate inventories increased by 0.5 mmbbls and 0.4 mmbbls respectively. Now, crude inventories align with the five-year average for this time of the year, while gasoline and distillate inventories drop back by 7% and 14%, respectively. With diesel days of supply back up to 30 days, markets are feeling a bit less pressure on the supply end.

The oil market landscape remains turbulent, with analysts noting a significant disappointment among producers and investors who had hoped the output cuts announced by OPEC+ in early April, coupled with Saudi Arabia’s additional voluntary cut in June, would quickly push prices higher. However, with supply and demand just about equal and hanging on a thin line, the market’s bounce back is going to take some time.

Prices in Review

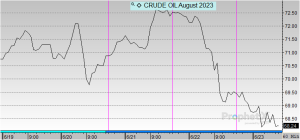

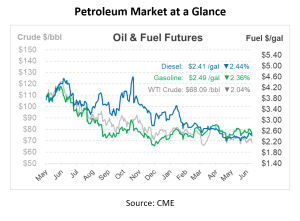

Crude opened on Tuesday at $71.45 before hitting a peak of $72.65 on Thursday. This morning, crude opened at $69.53, a drop of $1.92 or -2.687%.

Diesel opened on Tuesday at $2.5514 and climbed two days in a row before dropping off to $2.4697 this morning accounting for a decrease of around 8 cents or -3.2%.

Gasoline opened at $2.6671 on Tuesday and trended with crude, peaking at its highest on Thursday with a price of $2.6211. This morning gasoline opened at $2.5559, a dip of 11 cents or -4.17%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.