Oil Markets are Weary Ahead of Debt Ceiling Decisions and OPEC Supply Agreements

Coming off the holiday weekend and the commencement of the summer driving season, crude futures kicked off Tuesday’s trading on a lower note, reflecting a nearly 2% dip in oil prices. This downturn is a signal of the market’s cautious sentiment, influenced by the unresolved U.S. debt ceiling deal and unclear messaging from leading oil producers about the supply outlook.

The proposed “Fiscal Responsibility Act,” which intends to suspend the U.S. debt ceiling until 2025, still awaits congressional approval. Both President Biden and House Speaker McCarthy, the architects of the agreement, predict that the bill will pass before the imminent Monday deadline. However, the uncertainty surrounding this bipartisan effort to raise the $31.4 trillion U.S. debt ceiling keeps the market on its toes. As the House of Representatives, Rules Committee reviews the bill, oil prices remain constrained, with investors eagerly awaiting a resolution that may trigger a market reaction.

Simultaneously, the oil market grapples with potential changes in OPEC+’s policies. As the June 4th OPEC+ meeting draws near, speculations on whether the group will intensify their output cuts amid recent price drops add to market anxiety. Mixed signals from major OPEC producers and their allies have further fueled price volatility. In particular, Russian Deputy Prime Minister Alexander Novak’s recent assertion that OPEC+ might not further curtail production has cast a shadow of uncertainty.

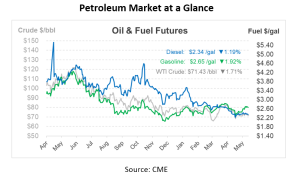

Brent crude futures, impacted by these complexities, slipped by 1.8% to $75.71/bbl this morning, while U.S. West Texas Intermediate (WTI) crude dropped 1.6% to $71.48/bbl.

In anticipation of a significant business cycle downturn, investors brace for potential hits to petroleum consumption and prices through the rest of 2023. Despite this, gasoline and diesel prices are expected to be more resilient than crude oil. Given that fuel stocks are currently beneath the long-term seasonal averages, and refineries are processing crude at a higher rate, stronger performance is anticipated for these fuels. Specifically, gasoline’s lower exposure to the industrial cycle compared to crude or middle distillates such as diesel and gas oil suggests it may outperform in the market.

This article is part of Daily Market News & Insights

Tagged: Oil Markets 2023, OPEC Supply Agreements

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.