Week in Review – May 5, 2023

Oil markets have experienced significant volatility this week as the Federal Reserve continued a 13-month tightening cycle, raising interest rates by an addition 25 basis points. That means the federal funds interest rate is now above 5%, the highest since 2007. Amidst this, the repercussions of bank failures continued to unfold, impacting oil markets and the global economy.

As a recent headline from oilprice.com proclaimed, “Gloom And Doom Dominates Oil Markets.” Although oil fundamentals point to low inventories and tight supply, the market is focused entirely on the demand end of the equation. If the economy slows and oil demand falls, then low inventories will fix themselves. This week saw oil prices fall nearly 10% for US and global benchmark crude prices, though there’s been a bit of recovery later in the week thanks to the European Central Bank announcing slower rate hikes.

Demand concerns in major oil-consuming nations, such as the United States and China, contributed to the heavy decline. Weak manufacturing growth in China created concerns that the world’s largest petroleum importer may be struggling. The U.S. Federal Reserve’s interest rate hike on Wednesday further limited near-term economic growth prospects, prompting a slide in oil prices. Nevertheless, the market found some support as the Fed signaled a potential pause in additional rate increases, allowing time for officials to assess the fallout from recent bank failures and gain clarity on the ongoing dispute regarding the U.S. debt ceiling.

OPEC and its allies, including Russia – collectively referred to as OPEC+ – initiated voluntary output cuts at the beginning of May. Russian Deputy Prime Minister Alexander Novak confirmed on Thursday that Russia was complying with its pledge to reduce oil output by 500,000 bpd from February through the end of the year. Of course, Russia’s “voluntary” cut is more attributable to western sanctions than to their own decision. The group is rumored to be considering even more cuts at their June meeting, since markets seem to be faltering.

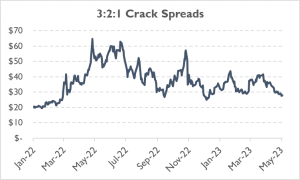

On the fuel side, crack spreads (representing refining margin from converting crude into fuels) are continuing to decline, though they remain above pre-invasion levels. Before Russia invaded Ukraine, crack spreads tended to move within a $10-$22/bbl range. After rising above $60/bbl at some points last year, crack spreads are currently sitting near $27/bbl. From a trends standpoint, this shows that fuel market supplies are improving and markets are growing more comfortable with current fuel inventories – though still not as comfortable as they were before the invasion.

Prices in Review

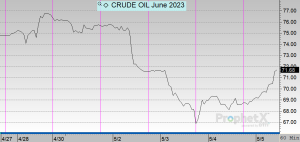

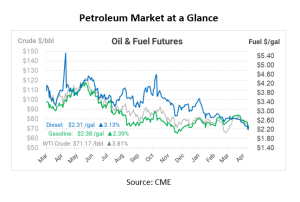

Crude oil opened the week at $76.66, but quickly sank on Tuesday down towards $70/bbl. Losses continued on Wednesday and Thursday, with the market briefly touching $63 – a 15% drop for the week! But prices recovered a bit, opening on Friday at $68.70. That represents a loss of nearly $8/bbl (-10.4%).

Diesel prices also took a hit this week. Opening at $2.37, it sank down to almost $2.15 during overnight trading Wednesday. The market did climb higher again though, opening at $2.24 for a 13 cent loss (-5.5%).

Gasoline markets were similarly impacted by market bearishness. Gasoline opened the week at $2.53 and fell near $2.25 before recovering. This morning, the market opened at $2.3255, a loss of almost 21 cents (-8.2%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.