Natural Gas News – May 2, 2023

Natural Gas News – May 2, 2023

Natural Gas Forecast: Prices Fall on Record-Breaking US Gas Output

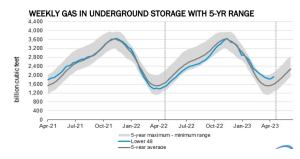

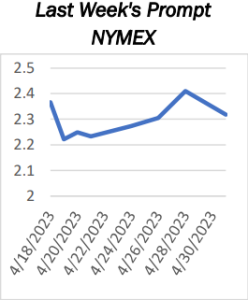

On Tuesday, U.S. natural gas futures are experiencing a downward trend. This follows a decline of approximately 4% in the previous session. This drop was due to the forecast of milder weather and reduced heating demand next week, which were not as severe as initially anticipated, coupled with record output levels. In contrast, on Friday, the same futures contract increased by approximately 2%, closing at its highest level since March 16th. At 12:00 GMT, Natural Gas is trading $2.1305, down $0.0255 or -1.18%. On Monday, the United States Natural Gas Fund ETF (UNG) settled at $6.76, down $0.25 or -3.57%. Looking forward, the premium of the November 2023 contract over the October 2023 has reached a historic high of 46 cents. This spread between October and November is often used by the industry to speculate on winter… For more info go to https://bit.ly/3LprDzk

Berkeley Gas Hookup Ban Tossed Out by Federal Court

In 2019, Berkeley became the first US city to ban new natural gas hookups in building construction. This week, a three-judge panel of the Ninth Circuit of the US Court of Appeals cited a 1975 law to toss out Berkeley’s ban. Since 2019, Berkeley’s law has been adopted in one form or another by cities across the US—including more than 70 cities in California—and last week, tentatively, by New York State. The jurisdiction of the Ninth Circuit panel is restricted to 11 Western states and territories, but its ruling sends a strong signal that a national legal test of gas hookup bans may be looming. The three-judge panel found the Berkeley ban to be in violation of the 1975 Energy Policy and Conservation Act, which gave the US Department of Energy the sole authority to set appliance energy stand… For more info go to https://bit.ly/3LNRvX5

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.