Week in Review – March 3, 2023

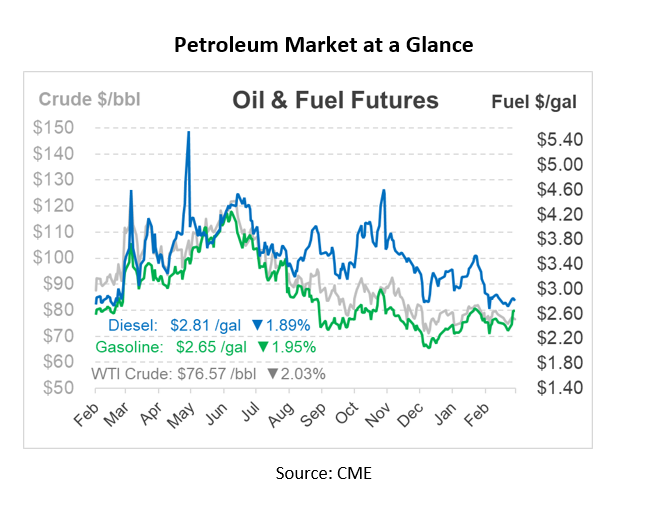

Crude prices have been on a rollercoaster ride this week, with a dip in prices followed by a few days of modest gains. Today’s prompt crude prices are down by about $1.60, but they remain on track for a weekly gain. As the market struggles with forecasts of higher US interest rates and a resulting slowdown in economic growth, improving Chinese demand based on positive mobility and factory indicators, and Russian supply reductions, prompt crude has remained within a range of $10/bbl this year.

Crude saw a modest gain on Thursday making it three days in a row of gains, backed by signs of a recovery in Chinese demand and hawkish statements from the Fed that it would be able to suspend rate increases by this summer. Nonetheless, Goldman Sach’s investment team increased their core PCE inflation projections due to ongoing US inflation fears.

After the EIA reported a lower than anticipated petroleum build because of heavy exports, crude prices increased on Wednesday. Moreover, this week was International Energy Week in London. WTI and Brent prices moved near their highest levels in around two weeks, putting them on pace for a weekly rise of about 2%.

While on the subject of crude, Russia intends to increase its seaborne diesel exports in March to 2.77 mm tons, rising 1.3% since February, as per industry statistics obtained by BBG. This would be the highest level in at least three years if it transpired. Notwithstanding the EU’s ban on Russian crude, which went into effect on February 5th, Russia has since diverted supplies to nations like Brazil, Morocco, South Korea, and Singapore.

Although the futures for diesel and gasoline are lower, they still seem to be headed higher for the week. According to OPIS MarginPro statistics, the average gross rack-to-retail margin for gasoline slipped to 24.8cts/gal on Thursday. Margin declines are now at 16.5 cents per week and 17.8 cents per month.

Prices in Review

Crude oil prices opened the week at $75.15, its lowest for the week. Crude remained around the $76-77 range for most of the week, before jumping to $78.20 on Thursday. Opening this morning at $78.07, crude has now dipped to $76.67, still up for the week overall.

Although diesel prices appear to be in an up and down swing this week, it has remained within the $2.80 range all week. Yesterday, diesel peaked at $2.903, and has since tapered off around $2.8195 this morning, a loss of 84 cents.

Gasoline was on track with crude this week as it remained mostly unwavering, except for a spike on Wednesday to $2.6756 after opening at $2.3535 on Monday, accounting for a 32-cent increase. That increase held true for the rest of the week. This morning, gasoline opened at $2.6951, up 14.51%. The increase appears large on paper, but the large uptick is really the result of normal seasonal changes. When the March contract expired and rolled to an April contract, the market began pricing in next month’s switch to summer gasoline throughout the US.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.