Natural Gas News – February 14, 2023

Natural Gas News – February 14, 2023

U.S. NatGas Gains 2% on Rising LNG Exports Ahead of Storage Report

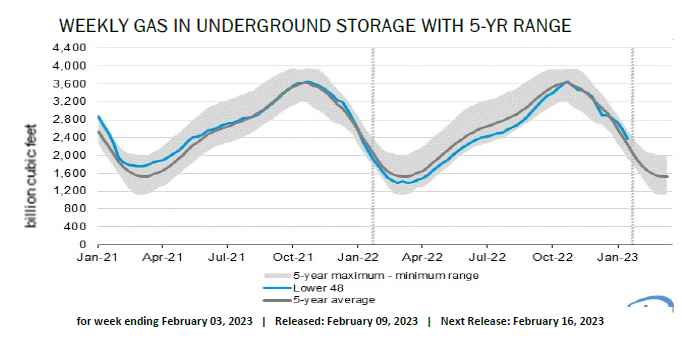

U.S. natural gas futures gained about 2% on Thursday after dropping to a 25-month low in the prior session on rising LNG exports and forecasts for slightly colder weather over the next two weeks than previously expected. That small price increase came ahead of a federal report expected to show last week’s storage withdrawal was bigger than usual for the first time this year as cold weather boosted demand for gas to heat homes and businesses. Analysts forecast U.S. utilities pulled 195 bcf (billion cubic feet) of gas from storage during the week ended Feb. 3. That compares with a decrease of 228 bcf in the same week last year and a five-year (2018-2022) average decline… For more info go to https://bit.ly/3YwyXyg

Nat-Gas Rallies On Partial Reopening Of Freeport Export Terminal

Mar nat-gas Friday closed sharply higher after Freeport LNG said it received federal permission to resume nat-gas exports from its recently repaired terminal and that it will resume some shipments on Saturday. The Freeport LNG export terminal has been closed since an explosion on June 8 and has been a bearish factor for nat-gas prices since the reduction in LNG exports has boosted U.S. nat-gas inventories. Lower-48 state dry gas production on Friday was 99.9 bcf (+4.6% y/y), moderately below the record high of 103.6 bcf posted on Oct 3, according to BNEF. Lower-48 state gas demand Friday was 87.2 bcf/day, unchanged y/y, according to BNEF. On Friday, LNG net flows to U.S. LNG export terminals were 12.8 bcf/day, up +5.5% w/w. Nat-gas prices fell sharply over the past two months… For more info go to https://bit.ly/3HX77UR

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.