Natural Gas News – November 22, 2022

Natural Gas News – November 22, 2022

Global Long-Term LNG Contracts Are Sold Out Until 2026

The global long-term LNG contracts before 2026 are sold out, top importer Japan says, amid heated competition for the fuel as Europe seeks to replace Russian pipeline gas supply. The estimate of sold-out LNG deals emerged from a survey of Japanese companies conducted by the local trade ministry and cited by Bloomberg. High spot LNG prices have priced out many Asian buyers this year as Europe has been bidding for supply and has become the primary destination of spot LNG supply out of the United States. At the same time, market volatility and uncertainties, and concerns about energy security, have prompted a growing number of buyers to seek long-term contracts. The race for LNG supply could give rise to the second wave of U.S. LNG projects, but new supply will take time to develop, Kateryna Filippenko, Principal… For more info go to https://bit.ly/3GDhiiC

U.S. Gas Prices Jump As Freeport LNG Targets Full Restart In March

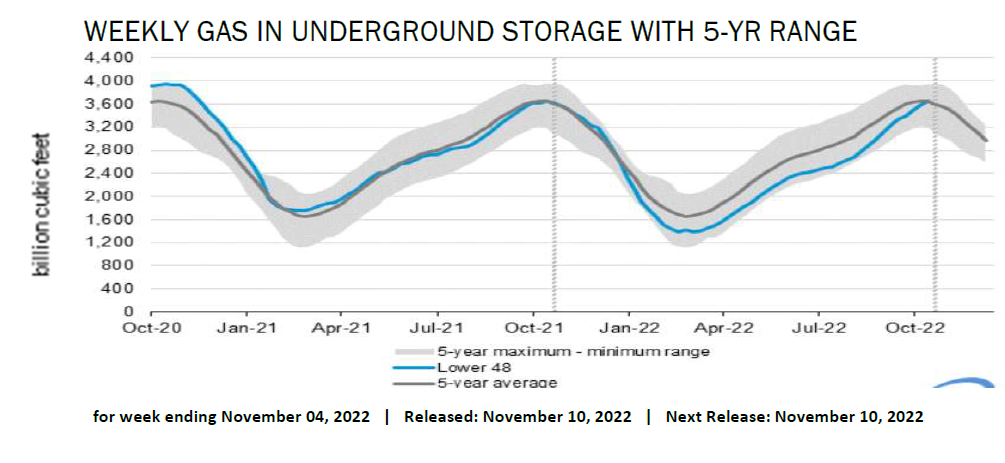

U.S. natural gas prices surged on the news that one of the largest U.S. LNG export terminals is targeting a complete operational restart by March 2023. Freeport LNG, a major liquefied natural gas exporter in Texas, wrote in a press release that “it is targeting initial production at the facility in mid-December,” with “full production utilizing both docks remains anticipated to commence in March 2023.” Remember, Freeport has been shuttered since June due to an explosion, with an initial reopening timeframe around fall. The delay has a silver lining: more NatGas will be injected back into the US grid as the heating season begins, though the bad news is that Europe will receive fewer shipments of US LNG shipments. “Each of Freeport LNG’s three liquefaction trains will be restarted and… For more info go to https://bit.ly/3UWINYL

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.