NATURAL GAS NEWS – November 10, 2022

NATURAL GAS NEWS – November 10, 2022

Energy Crisis Sparks Mad Dash For Floating LNG Terminals

Demand for LNG floating storage and regasification units (LNG-FSRUs) has increased sharply this year, with Europe facing an energy supply squeeze as Russia has progressively cut pipeline gas flows. Demand for LNG imports has intensified after the ruptures on the key Nord Stream pipeline system quashed any prospect of Russia turning its gas taps back on. This has forced dozens of countries in Europe to turn to FSRUs or floating LNG terminals, which are essentially mobile terminals that unload the super-chilled fuel and pipe it into onshore networks. Currently, there are 48 FSRUs in operation globally, with Rystad Energy revealing that all but six of them are locked into term charters. According to energy think-tank Ember, the EU has lined up plans for as many as 19 new FSRU projects at an estimated cost… For more info go to https://bit.ly/3fWZ9Bh

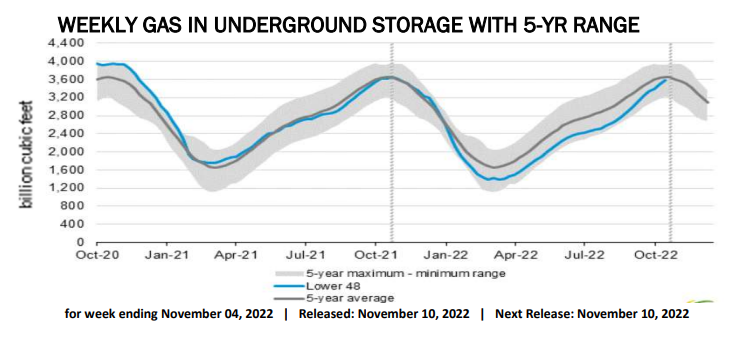

Winter is apt to bring higher natural gas prices, or not

When Old Man Winter bears down in the coming months, Colorado Springs Utilities’ customers might be surprised to see their natural gas rates either remain stable or decline from last year. That’s because the city-owned utility passes fuel charges directly on to customers, and the natural gas market, while volatile, isn’t showing signs that prices will go into orbit. After City Council, which also serves as the Utilities Board, adopted a higher gas cost adjustment (GCA) effective Oct. 1, the increase forced the gas portion of a typical residential bill up by only $4 a month (5.7 percent) from its previous level. Because the Electric Cost Adjustment for fuel dipped by about 4.3 percent, the typical total monthly bill changed only slightly, going down from $287.33 to $287.01. Commercial and… For more info go to https://bit.ly/3G01y8V

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.