EU Russian Oil Embargo – What Does This Mean for U.S. Consumers Long Term?

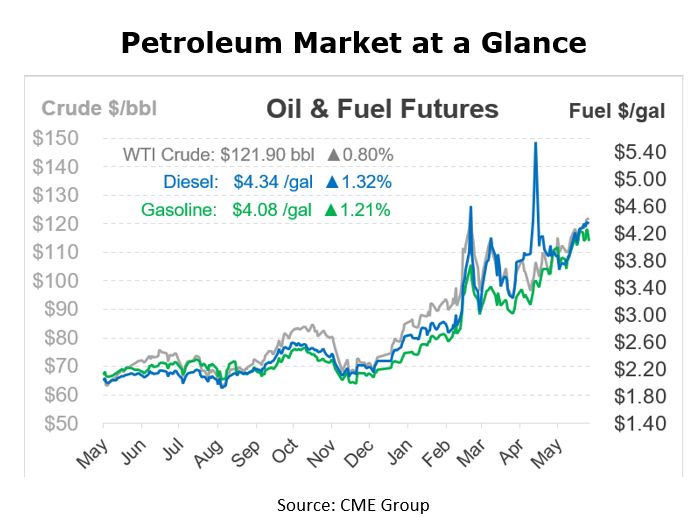

Now that we have had time to digest the EU Russian oil embargo. What does this mean for U.S. consumers long term? Considering the world works to balance towards Supply & Demand equilibrium. High prices in one part of the world triggers supply movements to compensate. Thus, indicating that price is the ultimate trigger and call to action.

Take the below graphic for example. The blue bar is the YoY change in OECD countries petroleum inventory levels. The orange line is the YoY change in the prompt vs. 12th month spread for the WTI futures contract.

When the futures market has a carry structure such as front month is cheaper. The market is indicating the desire to store product. The examples of 2008/2009 economic crisis and the 2020 covid fuel demand crisis. In both situations the change in the futures price spread. Encouraging the market to hold supply for a future time when needed.

In the opposite market, like we are experiencing in 2022. The futures market is in a state of backwardation (front month is higher), meaning there’s the sign to bring product to market.

To answer the question, what does the EU Embargo mean for the U.S. consumers? While we have no real direct impact from Russian oil. The indirect domino effect of the embargo mean prices here must rise (or stay higher). Encouraging more production and defend against export options.

By

Andy Milton

Sr. Vice President – Supply

This article is part of Daily Market News & Insights

Tagged: EU Russian Oil Embargo 2022

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.