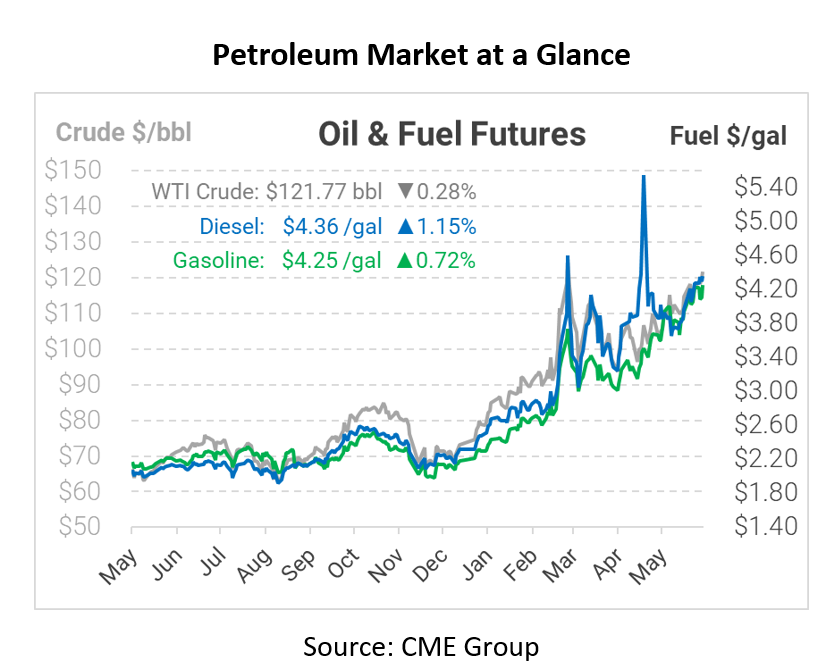

Oil Prices Hover Near 3-Month Highs

This morning oil prices are staying near 3-month highs as China imposes new lockdown restrictions in the financial hub of Shanghai due to the ongoing COVID-19 crisis. The new lockdowns come at a time when the future was looking brighter for Chinese residents after the previous restrictions saw millions locked up in their homes for extended periods of time.

In regard to demand, the ease-up of restrictions in China saw a boost to exports in the month of May. China saw a near 17% jump in exports during May compared to the prior year. Factories are starting to restart, and facilities are filling up with workers as people start to resume their daily lives, a great sign for the supply and demand chain moving forward. However, parts of Shanghai are still imposing new restrictions to minimize new exposure risks associated with the virus. “We believe this recovery can continue if there are no further lockdowns,” said Iris Pang, Greater China chief economist at ING. He also added that the rebound in both exports and imports was mainly due to the port recovery in Shanghai in the last week of May (Reuters).

In other news, U.S. crude inventories rose unexpectedly last week, according to new data from the Energy Information Administration (EIA). The Strategic Petroleum Reserve also fell by a record amount as refineries start to ramp up production. Crude inventories rose by 2 million barrels last week to a total of 416.8 million barrels. On the other side, the SPR crude stocks fell by a record amount of 7.3 million barrels to 519.3 million. This was the lowest recorded inventory level since March 1987.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.