Natural Gas News – May 25, 2022

Natural Gas News – May 25, 2022

U.S. Nat Gas Futures Jump 6%

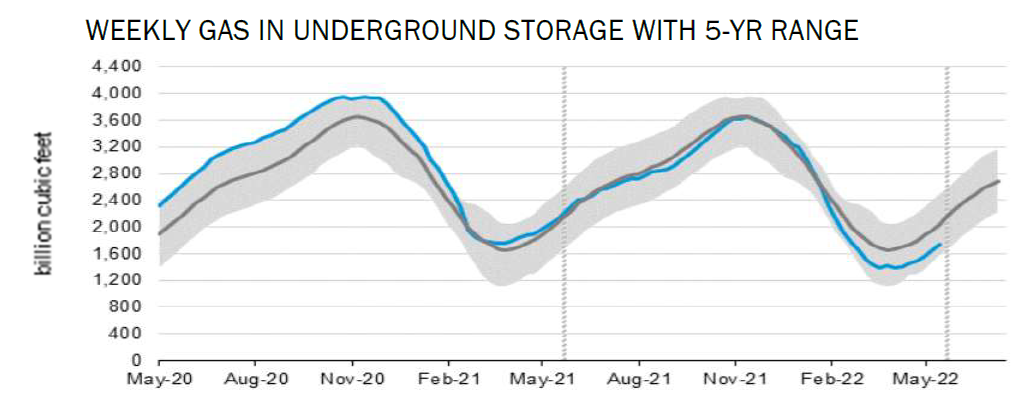

U.S. natural gas futures jumped about 6% on Monday to a two-week high as the most gas in seven weeks flowed to U.S. liquefied natural gas (LNG) export plants, prompting worries about how much was left to go into storage. With much higher European prices attracting LNG tankers from around the world, the amount of gas in U.S. storage compared to normal levels for this time of year has fallen below the amount available in Northwest European stockpiles. European prices remain about triple U.S. prices, but were trading at their lowest level since before Russia invaded Ukraine on Feb. 24, partly because stockpiles in Europe are filling fast. U.S. front-month gas futures NGc1 for June delivery rose 46.3 cents, or 5.7%, to $8.546 per million British thermal units (mmBtu) at 12:09 p.m. EDT (1609 GMT), putting the contract… For more info go to https://s.nikkei.com/3sU7Q2y

Germany is Keen to Pursue Gas Projects

Germany wants to intensively pursue gas and renewable energy projects with Senegal, Chancellor Olaf Scholz said on Sunday during his first trip to Africa, against the backdrop of the war in Ukraine and its impact on energy and food prices. Scholz kicked off the three-day tour in Senegal, which has billions of cubic metres of gas reserves and is expected to become a major gas producer in the region. Germany is seeking to reduce its heavy reliance on Russia for gas following the Kremlin’s invasion of Ukraine. It has initiated talks with the Senegalese authorities about gas extraction and liquified natural gas, Scholz said. “It is a matter worth pursuing intensively,” he said at a news conference with Senegalese President Macky Sall, adding that progress in the talks was in the two countries… For more info go to https://reut.rs/3wOLzUL

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.