Is IMO 2020 Causing the Diesel Shortage?

Several years ago, a branch of the United Nations passed an environmental regulation requiring marine vessels to reduce their sulfur emissions. This obscure policy change – which exploded in the literature around 2019 – was known as IMO 2020. At the time, FUELSNews covered the change in detail, since the change was forecast to cause a 20+ cent increase in diesel prices. A pandemic deeply muted the effect of the decision, but now at least one economist is warning that this rule change is the secret culprit behind soaring diesel prices.

In a recent report from Phil Verleger, an economist famous for warning that $200/bbl oil would become a reality thanks to IMO 2020, he notes that IMO 2020 is a major contributor to higher diesel demand. Before 2020, the marine industry could take the high-sulfur residual fuels that are leftover after the refining process extracts enough diesel and gasoline. Now, they must compete for the desulfurized materials, leaving more unwanted “residual” fuel and less distillate. Early forecasts indicated increased demand of 2.5 million barrels per day for diesel fuel.

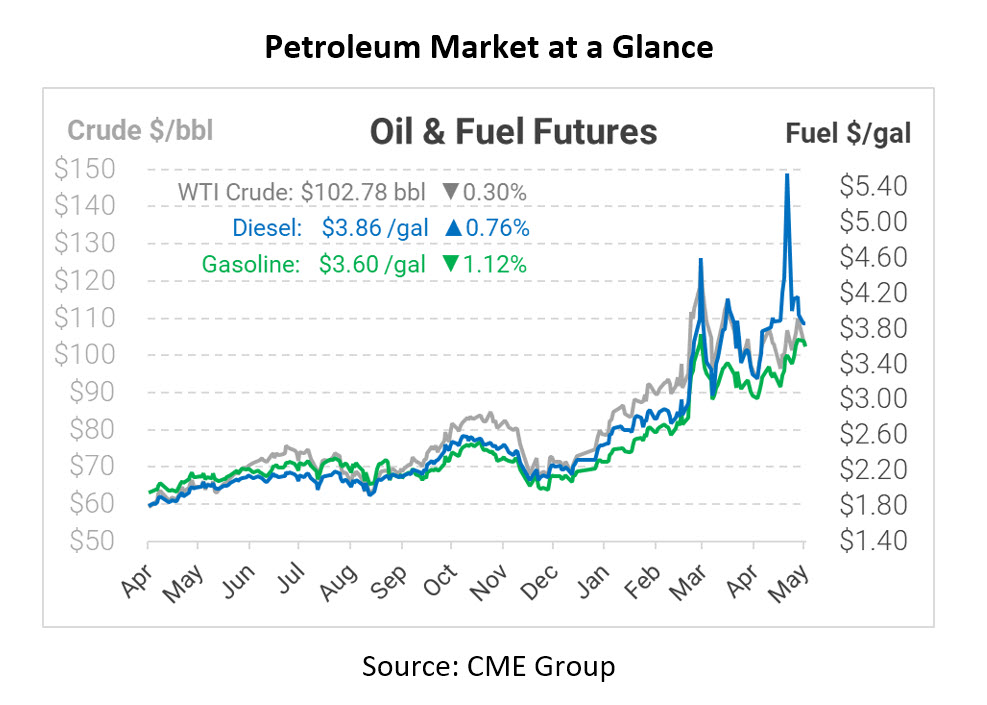

What does this mean for fuel? Verleger warns that diesel prices could remain elevated for months or years if IMO 2020 is not repealed. Even as other fuel costs stay stable and fall, diesel will remain high. Diesel demand is not as elastic as gasoline – truck drivers can’t simply cancel their trip the way consumers may cancel a vacation. Because demand is here to stay, Verleger warns prices could move to “unimaginably high levels” or plunge the world into an economic slowdown.

Of course, Verleger’s predictions were widely dismissed in 2019 as too aggressive, with most economists expecting a more moderate impact from the IMO 2020 change. It’s clear, though, that high demand and restricted supply is causing a diesel shortage worldwide. Repealing IMO 2020 is one possible avenue to reducing demand, though currently the UN has no plans to change the regulation.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.