Impact of IMO 2020 on Fuel Prices

IMO 2020 is upcoming legislation that impacts marine transportation, however its indirect impact is forecasted to extend to U.S. ground fleets that are likely to experience tighter low-sulfur diesel supply and higher prices.

There’s a huge change coming for oil. No, it’s not electric vehicles or CNG. This change is more obvious, more immediate – and yet much less frequently discussed. The coming alteration will cause substantial price shockwaves for oil products including gasoline and diesel. The change – often referred to as IMO 2020 – is the conversion of maritime fleets from 3.5% sulfur levels down to .5% sulfur.

Introducing IMO 2020

The International Maritime Organization (IMO) is a branch of the United Nations that sets global standards for international shipping. Their regulations cover a range of requirements, including fuel standards, ship designs, labor requirements, disposal and more.

The upcoming policy change, which will affect all maritime vessels on the open seas, poses significant challenges for refineries, suppliers and maritime fleets. The reason for the policy change is environmental – Goldman Sachs indicates the maritime industry accounts for over 90% of transport sector sulfur emissions. International Maritime Organization research shows the reduced SOx emissions from IMO 2020 will prevent 570,000 premature deaths globally between 2020 and 2025.

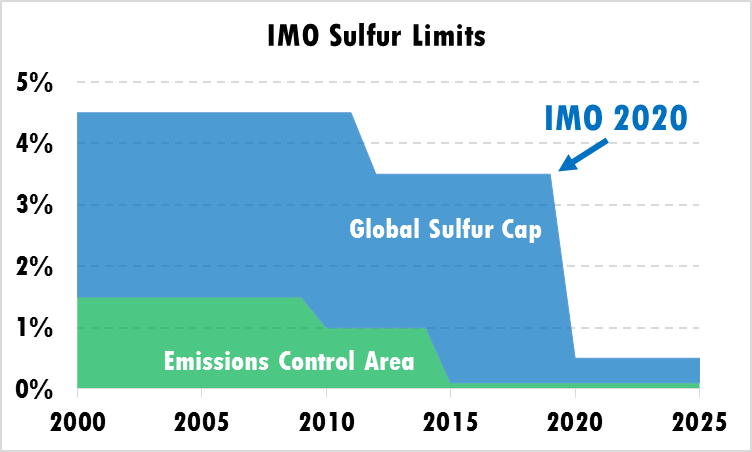

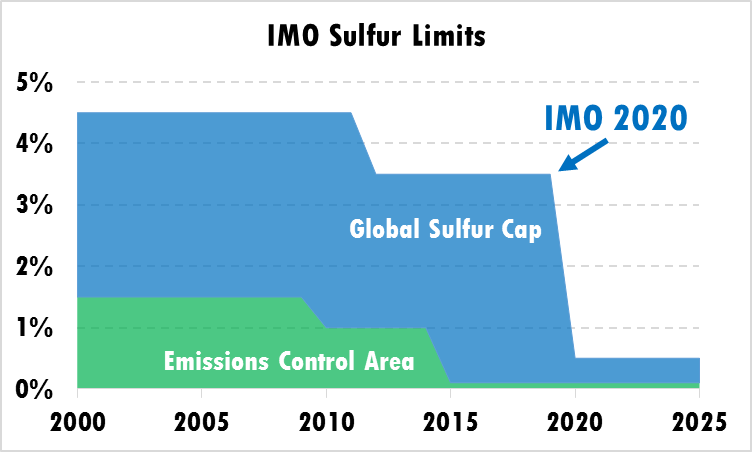

This isn’t the first time the maritime industry has faced a changing emissions standard, though this is orders of magnitude larger than previous changes. In 2010, global sulfur caps were dropped from 4.5% to 3.5%. In the Emissions Control Area (maritime area immediately surrounding Europe and North America), sulfur requirements are quite stringent, currently at 0.1% sulfur. Vessels leaving Europe, for instance, must burn low-sulfur fuel oil until they are outside the ECA, at which point they can burn higher sulfur bunker fuels. Individual countries such as China have imposed their own ECAs on their surrounding bodies of water.

Source: International Maritime Organization

How Do Vessels Currently Fuel?

Maritime vessels use what’s called “bunker fuel”, or residual fuel oil, which is the bottom heavy gunk in a barrel of crude. If gasoline is the lightest part of crude (i.e. the shortest hydrocarbon molecule and most likely to combust) and diesel is in the middle, bunker fuel is just barely above asphalt – super viscous, dark and heavy.

The refining process is complex. Refineries take crude oil and heat it, cracking the crude molecules into various components and separating the heavy types of fuel (bunker fuel) from the lighter fuels (like gasoline). In newer, complex refineries, bunker fuel is reprocessed in various ways to extract every bit of lighter hydrocarbon possible, since gasoline, diesel, kerosene and jet fuel are all far more valuable than the heavier residual fuels. In fact, the name “residual fuels” is a clue to the fact that bunker fuel is simply a leftover.

Bunker fuel is usually blended with a bit of high-sulfur diesel to make it flow more easily and burn more quickly. Remember, high-sulfur diesel was once legal for use by over-the-road transportation, before the 2006 conversion to ultra-low sulfur diesel (ULSD). Most fuel burned by maritime vessels is some combination of high sulfur diesel and bunker fuel, though in Emission Control Areas ships are already using low-sulfur blends.

What Will Ship Owners Do?

With the mandate from the IMO, ship owners are faced with choices on how to comply. Overall, analysts from Wood Mackenzie expect compliance to add $60 billion in costs for the maritime industry. Goldman Sachs estimates a total cost of $240 billion when accounting for higher fuel prices in other industries. So how are ship owners choosing to respond to new fuel standard? They have a few options:

- Use Compliant Fuels. Use marine gasoil (MGO) or other low-sulfur diesel-like blends to meet compliance.

- Use After-Treatment to Scrub Sulfur. Install “scrubbers”, or Exhaust Gas Cleaning Systems, to remove the douse emissions with alkaline water and remove the sulfur. At an expected price tag of $5 million per ship, scrubbers are a hefty capital expense.

- Switch to Liquefied Natural Gas. LNG is a low-sulfur alternative to bunker fuel. However, converting a fleet to LNG is extremely costly and cuts into a ship’s total available capacity. This is akin to converting a truck fleet to CNG due to high diesel prices.

- Ignore the requirement and use high-sulfur fuel. Of course, operators can choose to use non-compliant fuels and risk the punishment. IMO 2020 implementation is left to member nations, so some countries could be lax in enforcement. Ships can only be penalized by the country whose flag they fly.

Stillwater Associates estimates cheating could account for 10% of total fuel consumption. For the rest, the alternative will likely choose the first option, at least initially. Large maritime vessels have a life expectancy of roughly 20-25 years, so older ships will not last long enough to benefit from retrofitting with LNG engines or scrubbers.

Wells Fargo research forecasts only 10% of vessels will move to scrubbers. Estimates vary widely depending on the source, but few analysts expect more than 20% of the global maritime fleet to switch to scrubbers or LNG. The rest, then will need to find compliant fuels.

Is There Enough Fuel?

All of these changes have led markets to wonder – will there be enough low-sulfur fuel to meet the requirements? As noted earlier, residual fuel is already processed and reprocessed to extract every bit of low-sulfur gasoil possible. How much more can they eke out? Market analysts disagree.

The IMO relies on the research of CE Delft, a European research company specializing in environmental studies. That study found there would be enough refining capacity globally to keep up with demand, assuming all refineries have the required sulfur processing capacity. Other studies point out how older refineries cannot simply change how they process fuels.

Newer refineries, such as those in the U.S. Gulf Coast, are able to adjust their input and process out more sulfur. Other refineries may not be able to accomplish this. A rival study submitted to the IMO notes roughly 60% more sulfur plants need to be built to accommodate the change.

There’s also a crude oil problem. “Sweet” crudes like American WTI or European Brent fuel have relatively low sulfur rates already, which make them ideal for blending into low-sulfur fuels. “Sour” crudes such as blends from Mexico or Venezuela are laden with sulfur and require far more processing to clean. Analysts expect sweet crudes to become relatively more expensive compared to sour crudes due to the IMO 2020 change.

Regardless of which group is right, the overall expectation is that around 2.5 million barrels per day of additional low-sulfur diesel fuel will be needed by the maritime industry. Contrast that additional demand, against total global diesel demand, which is less than thirty million barrels per day. While some refineries can change their production methods and increase their diesel output, many others cannot, which means a large portion of that two million barrels per day will need to be siphoned away from existing demand, such as over-the-road and off-road diesel.

How Does This Impact the Rest of Us?

With more diesel being used by the maritime industry, there will be less available for use by land-based diesel consumers. The initial challenge will be price increases. Expected price impacts are the subject of extensive debate. Depending on your opinions on how well refineries can adapt, forecasts range from little/no impact to $10-20/bbl increases.

The rival study mentioned above noted that because global refining capacity could not keep up with higher demand, pressure would build for all types of fuel, not just diesel, causing prices to rise $10-20 per barrel. Per gallon, that equates to a 25—50 cent increase in diesel and gasoline prices.

Wells Fargo takes a somewhat more conservative approach, estimating prices could increase by around $5 per diesel barrel ($.12 per gallon) and $2 per gasoline barrel ($.05 per gallon). It’s worth noting both of these prices are on top of any changes in underlying crude prices.

Beyond price risk, there’s a credible question of supply reliability, especially in coastal markets. With 10% of global diesel being apportioned elsewhere, trucking fleets will need to work harder to find supply. Fortunately, U.S. refineries are among the most sophisticated in the world, making them better equipped to handle the changes. Unfortunately, this sophistication will put American fuel in high demand, leading to higher export levels and less fuel available for consumption in traditional on-road uses.

Although IMO 2020 does not directly effect on-road and off-road trucking fleets in North America, the resulting impact on prices and supply reliability will surely be felt in late 2019 and into 2020. The worst impacts will be felt next year as markets scramble to make last-minute adjustments to accommodate maritime needs. Fleets that lock in reliable supply at a predictable price now will be best positioned to weather the stormy conditions that are coming for fuel prices.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.