Natural Gas News – April 12, 2022

Natural Gas News – April 12, 2022

U.S. Nat Gas Up 3% to 10-Week High on Big Storage

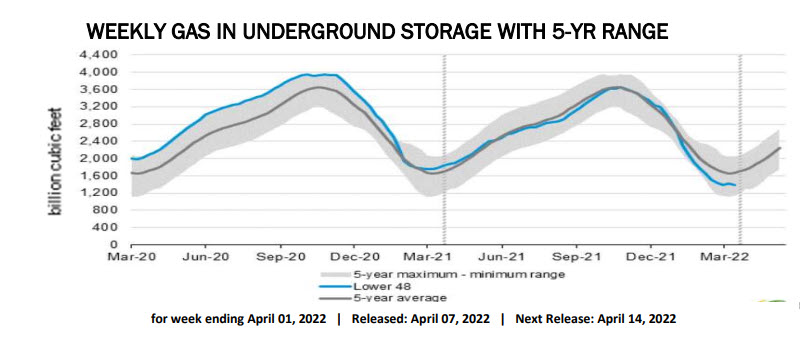

U.S. natural gas futures rose about 3% to a 10-week high on Thursday on a bigger than expected storage draw, a preliminary decline in output and forecasts for more power generation and liquefied natural gas (LNG) export demand for gas over the next two weeks. The U.S. Energy Information Administration (EIA) said utilities pulled 33 billion cubic feet (bcf) of gas from storage during the week of April 1. Analysts said storage withdrawal was due to cold weather last week and was likely the last decrease of the winter heating season. That was higher than the 26-bcf withdrawal analysts forecast in a Reuters poll and compares with an increase of 19 bcf in the same week last year and a five-year (2017-2021) average increase of 8 bcf. Last week’s decline cut stockpiles to 1.382 trillion cubic feet (tcf), or 17.1% below… For more info go to https://bit.ly/3rjyUHN

NYMEX Henry Hub May Remains Near 13-Year Highs

After settling at its highest price in over a decade on April 7, the NYMEX Henry Hub prompt-month contract largely kept its gains in April 8 trading, as a widening storage deficit and the strength of natural gas exports raised supply concerns. NYMEX Henry Hub May settled at $6.278/MMBtu April 8, just 8.1 cents lower than its prior-day settlement of $6.359/MMBtu on April 7, preliminary settlement data from CME Group shows. The April 7 daily settlement was the highest the prompt-month contract has reached since Dec. 2, 2008, according to data from S&P Global Commodity Insights. Even with the April 8 dip, the May contract has gained more than 70 cents since becoming the front-month contract. Late spring price rallies … For more info go to https://bit.ly/3O4pidy

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.