Will More Drilling Cause Prices to Fall?

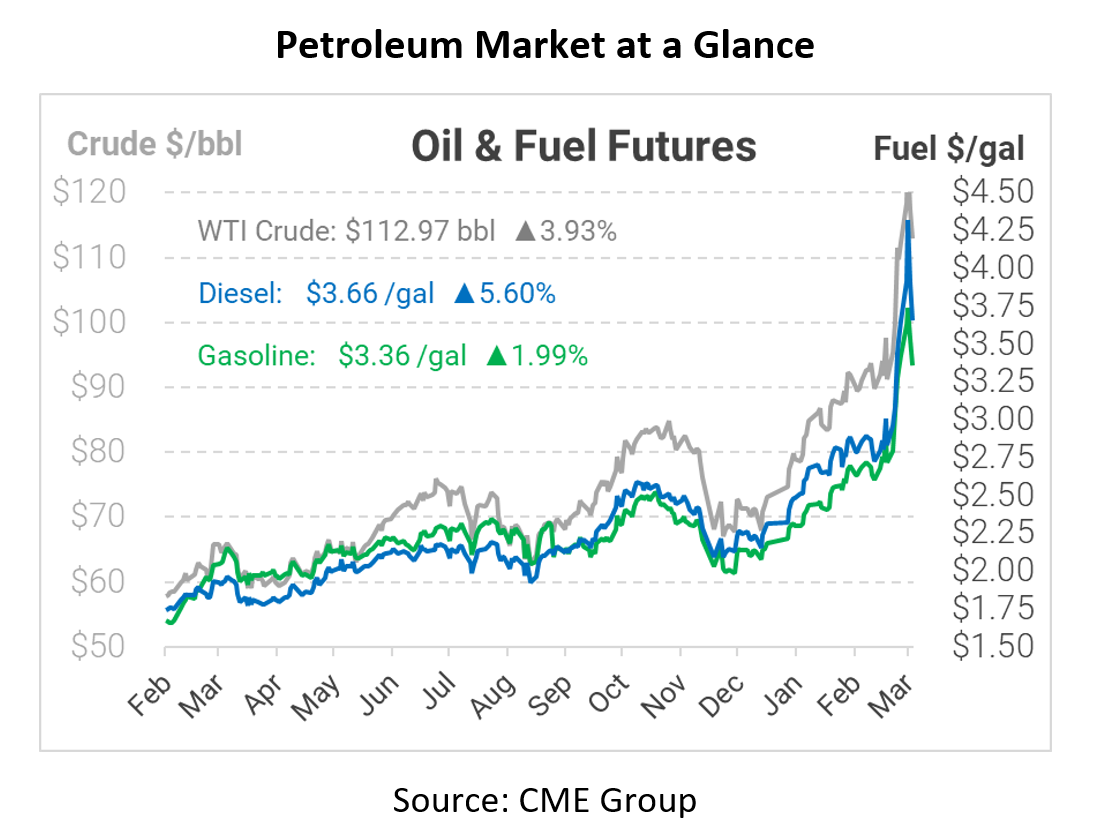

This week consumers have seen prices at the pump reach numbers never experienced. In most states it was hovering right around the $4.50 mark, but California was getting highs of $5.694/gallon for regular grade yesterday according to AAA. Add in extremely long lines and the frustration begins to pile on for Americans. Many politicians see what is happening and suggest that the answer is to just simply drill more oil, but would that really solve the problem?

As the world largest oil producer, the US produced around 11.6 million barrels of oil per day in December. Although that’s just shy of 2 million barrels per day below peak 2020 production, that’s still historically high. Biden’s attempt last year to halt new drilling on federal land was overturned in court, leading to a 98% approval rate for drilling permits last year. Unfortunately, new wells take 6-18 months to bring to full production, meaning that any projects approved today won’t begin until September at the earliest. Larger developments, such as Alaska’s ANWR field, would take a decade or more to begin flowing. The unfortunate reality is that there’s not much that oil producers can do to alleviate the immediate market pressure.

When it comes down to it, even if the United States supplied entirely their own gasoline and diesel, oil is still a true global commodity. Our consumers will never be completely isolated from global fluctuations, and other countries and groups including OPEC, Europe, Canada and more will need to open their oil flows to help balance the equation.

It is important to note that while the U.S. seems to have a severe oil price problem, it is nothing compared to the energy challenges facing Europeans. Just two days ago European natural gas prices were trading at €345 per megawatt-hour ($385 US). In Germany, consumers saw their per liter price of standard E10 gasoline climb above 2 euros, equating to $8.30/gal in US Dollars. This was the most historic price movement for fuel in their history. Norway has reported gasoline prices over $10/gal. So, at bad as prices have become in the US – perhaps we can be glad that it’s not quite as severe on this side of the pond.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.