Are Gas Prices Really Setting Record Highs?

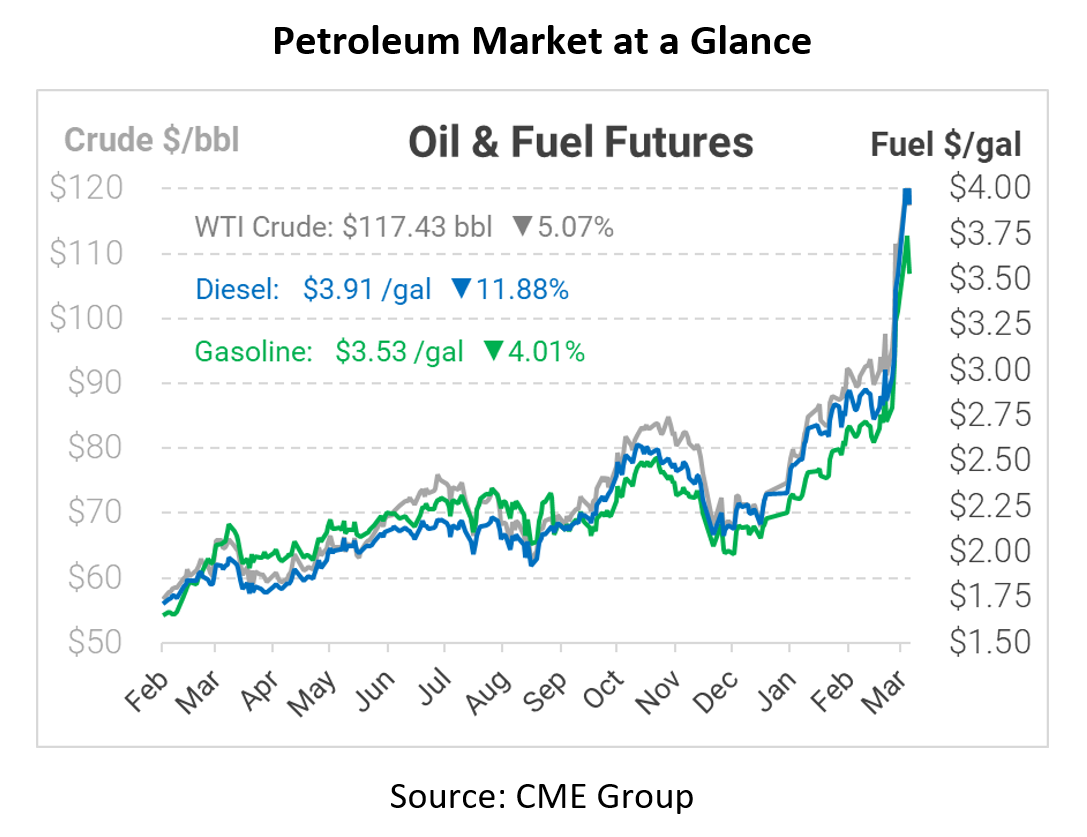

This morning marks the first full day of a complete ban of Russian oil by the United States. Because Russia is the third largest oil producer globally, the United States considers this ban as cutting off Russia’s “artery,” but many will still pay the price for such a decision. Prices have fallen steeply from yesterday’s incredible run-up in prices, but that doesn’t mean the rally is done. With gasoline prices reaching over $4 per gallon in many states, prices now appear to be at the highest average to date. But are they?

With major news outlet headlines now reading “oil and gas at record highs” it is easy to assume that they are telling us what we already know. But there is a major component to pricing that changes its meaning, and that missing component is inflation. With inflation being as high as it is, gas prices are not really setting record highs. First let’s look at gasoline. In real terms, retail gasoline would need to hit around $5.25 for it to be considered a “record-high” when adjusted for inflation. With gasoline accounting for nearly 3.4% of the average household total spending, fuel prices are a critical part of consumer spending. People must now account for rising prices, which will cut into other discretionary spending.

When we take a look at diesel, it is clear to see just how much inflation is impacting these so-called record prices. If you were to take NYMEX heating oil in 2008 for $3.90 and adjust for inflation, a gallon of wholesale ULSD would cost around $5.06. The main takeaway is that we are not really at an all-time high when you consider the effects of inflation – which also means there may be room for prices to run even higher. To run your own numbers and understand the effect of cumulative inflation, click here to run simulations with the inflation calculator.

Since 2008 consumer prices have risen roughly 30%, and they will continue to rise in the future. Right now, oil prices are not at record highs because inflation is not considered, but there is a real possibility that one day consumers could see prices at real record highs, even after inflation. With Russia’s situation pushing oil prices higher than most have ever seen them and little to no help from major exporters such as OPEC, the world will have to figure out their own way to cope with this pressing issue. High prices won’t go on like this forever, but more supply to the market is the first step in rebounding for the current situation.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.