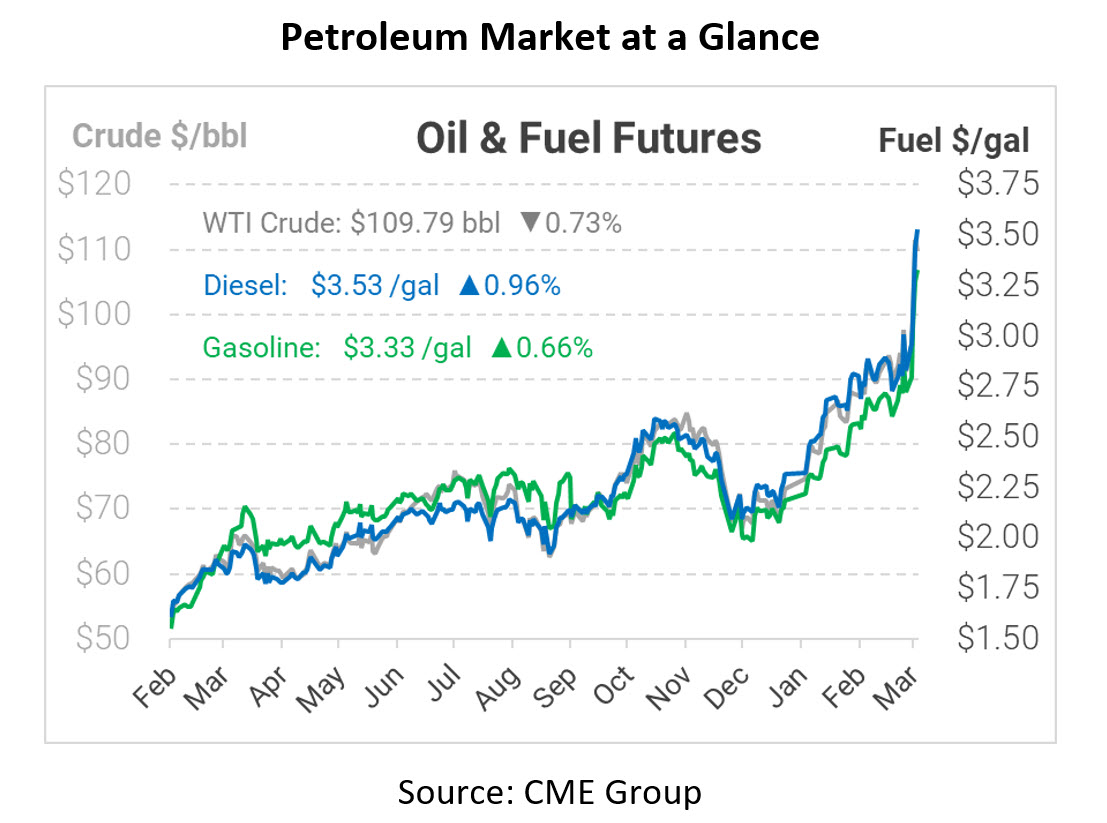

What’s Up with Oil Prices? Everything – Highest Prices Since 2008

This morning WTI crude reached highs not seen since 2008, breaching $116.57 at the peak this morning. After the spike prices have retreated and are hovering around the $110 mark. With escalating tensions in Ukraine amid the Russian invasion, high price volatility seems to be the current trajectory until the conflict is over.

Aside from crude prices rising, diesel is up 70 cents over the past week with a staggering 35 cent increase in price yesterday alone. Notably, yesterday was the largest single day increase in diesel history, with the previous record of 29 cents ominously set in June 2008. Since Russia’s invasion last week, gasoline prices are also up near 50 cents. It’s worth noting that sanctions are not directly targeting Russia’s oil. Despite this fact, traders are avoiding Russian products altogether, slowing down their exports by as much as 70%. That’s means a lot less crude is finding its way to global markets, creating some severe pricing situations. Specifically: backwardation.

In our FUELSNews article from January 27, we talked about what backwardation means. That is, the trading term that means the price of fuel in the future is lower than current rates. Today future prices are steeply backwardated, meaning that the NYMEX fuel price today is around 15-20 cents higher than the following month’s cost. This causes steep losses for companies holding inventories, which means many shippers and suppliers are reducing their positions. Over the coming weeks, this dynamic will diminish fuel inventories in markets already experiencing historically tight supplies. Goldman Sachs recently noted that supply cannot keep up with the current demand for oil, leaving demand destruction (via high prices) as the only mechanism for market balancing. If this is correct, it should be expected to continue seeing price volatility in the coming weeks.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.