The Upside Down. What Happens When Fuel Prices Are Reversed?

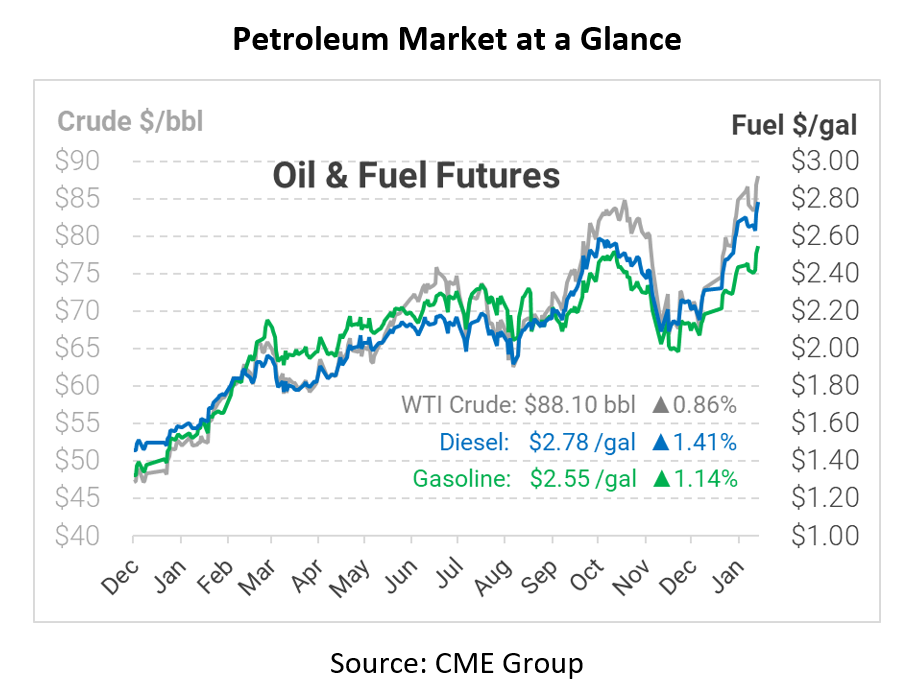

Market volatility is nothing new, but the recent price rally has sent prices screeching to multi-year highs. Yesterday’s EIA report, which showed falling diesel inventories, certainly did not help curb recent gains. Although it’s impossible to know the future, the current market situation that consumers are experiencing is a trend that often isn’t talked about – backwardation.

Markets are currently showing steep backwardation, a technical trading term that means the price of fuel in the future is lower than current rates. Now, markets are showing more than a 30-cent spread between February (“prompt month”) prices and December 2022 prices. What does backwardation mean for fuel buyers?

First off, it’s a bullish sign. This meaning may be surprising – markets are showing lower prices in the future, so why would that mean prices are going up? Traders are pushing up prices in the short term because there isn’t enough supply right now. That causes refiners to drain their inventories to benefit from current high prices before losing 30 cents per gallon! Selling inventories helps alleviate pressure now and leads to lower inventory levels and even tighter supply down the road. It’s a self-perpetuating cycle that continues until refiners can increase throughput enough to keep up with the record demand we’ve seen in the last couple of months.

For corporate fuel buyers, backwardation is also an opportunity. By blending a fixed price over the next 12 months, you can achieve a fixed rate that is much lower than current prices – meaning you get to enjoy prices closer to $2.40 or $2.50 over the next year even if the market keeps rising to $3/gal. Hundreds of large companies use this secret dynamic to keep their fuel prices competitive as the market rises.

With market factors pointing to continued growth and the market offering 30-cent discounts to those locking in a fixed price – is now the right time to lock in your fuel budget for the next 24 months?

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.