Natural Gas News – February 10, 2022

Natural Gas News – February 10, 2022

US EIA lifts natural gas demand, price forecasts for Q1 after cold start

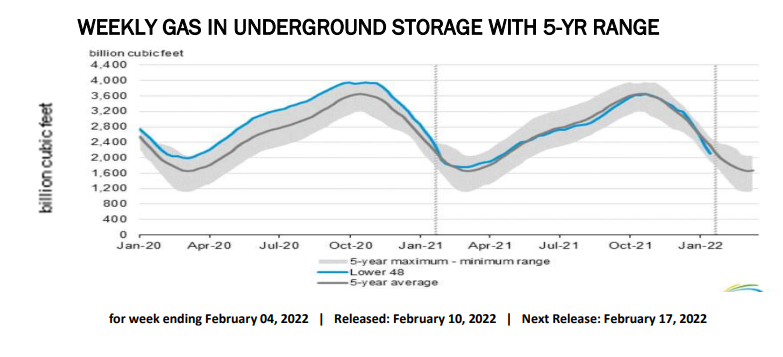

The US Energy Information Administration bumped up its US natural gas demand and price forecasts for the first quarter of 2022, following a colder-than-normal January in the Northeast and Midwest and anticipating continued strong demand for US LNG exports. EIA, in its February Short-Term Energy Outlook, raised its natural gas consumption estimates by 3.42 Bcf/d to 102.47 Bcf/d for Q1, and by 650 MMcf/d to 71.56 Bcf/d for Q2. It also pushed up its consumption forecasts by 1.50 Bcf/d to 84.27 Bcf/d for 2022 on average, and by 1.01 Bcf/d to 83.85 Bcf/d in 2023. Colder-than-normal weather in January increased demand for gas used for space heating and power generation, the agency said, noting the spot price at Henry Hub averaged $4.38/MMBtu for the month, up from $3.76/MMBtu in January. “EIA forecasts that natural gas … For more info go to https://bit.ly/3JhoTkL

SoCal spot gas prices shielded from heat wave impact by ample supply

Despite forecasts showing potential record-high temperatures, spot gas prices in Southern California slid in Feb. 9 trading amid gas storage availability and rebounding Permian supply. Cash SoCal, city-gates fell 20.50 cents to $3.915/MMBtu in Feb. 9 trading, while El Paso, South Mainline dipped 22 cents to $3.805/MMBtu, Platts preliminary settlement data shows. Regional spot gas prices have seen their basis spreads to cash Henry Hub flip to discounts in recent days, after maintaining strong premiums for most of December and January. SoCal city-gate’s spread to cash Henry came in at a 13.50-cent discount Feb. 9. The National Weather Service issued a rare winter heat advisory for Los Angeles and inland Southern California for Feb. 9-13, citing the potential for temperatures to climb into the… For more info go to https://bit.ly/3gDVXY4

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.