Natural Gas News – February 1, 2022

Natural Gas News – February 1, 2022

Explainer: Why U.S. natural gas prices spiked by a record 70% on Thursday

U.S. natural gas futures soared over 70% during the last half hour of trade on Thursday and closed up 46% in their highest daily percentage gains on record. The move puzzled a number of market-watchers, who struggled to explain what could have caused such a spike. The answer lies in the low-volume action because Thursday was the last day of that contract’s life – when very few buyers would be willing to take a position as most had already moved on to other contracts. These occurrences are becoming more common, though usually not on the order of what happened Thursday. “Gas contracts rolling off the board have gained an average 12.1 cents in 12 of the past 14 months on their final trading day,” analysts at EBW Analytics Group said. Thursday’s move was even more outsized. Prices rose from $4.84 per million British … For more info go to https://reut.rs/34dlvIG

Natural gas futures surge as powerful winter storm looms

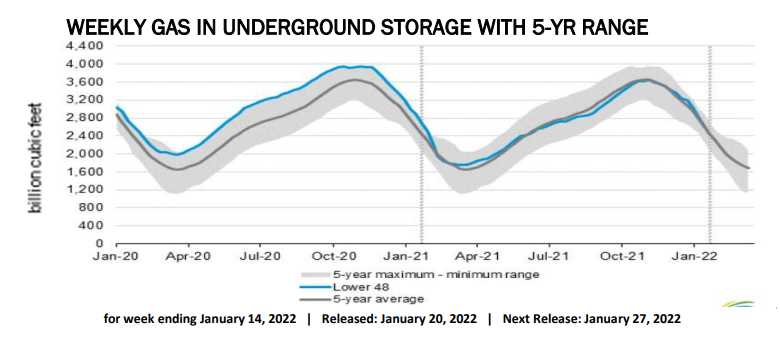

Natural gas futures are climbing sharply ahead of a blizzard that will force millions of Americans to crank up the heat. If maintained, the rally will translate to higher home heating costs in the weeks to come, adding to the inflationary pressures hitting the US economy. Natural gas futures expiring in March surged 12% on Friday to $4.79 per million British thermal units. The contract hit an intraday high of $4.88, the highest level since late November. For the week, the March natural gas contract is up more than 25%. Demand for natural gas, the most popular ways to heat homes in the United States, is likely to rise as Americans brace for a severe winter storm in the Northeast. More than 10 million people across 10 states are now in a blizzard warning. “We are already maxed out” in terms … For more info go to https://cnn.it/3uxqEq7

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.