Winter Storm Adds Pressure to Markets

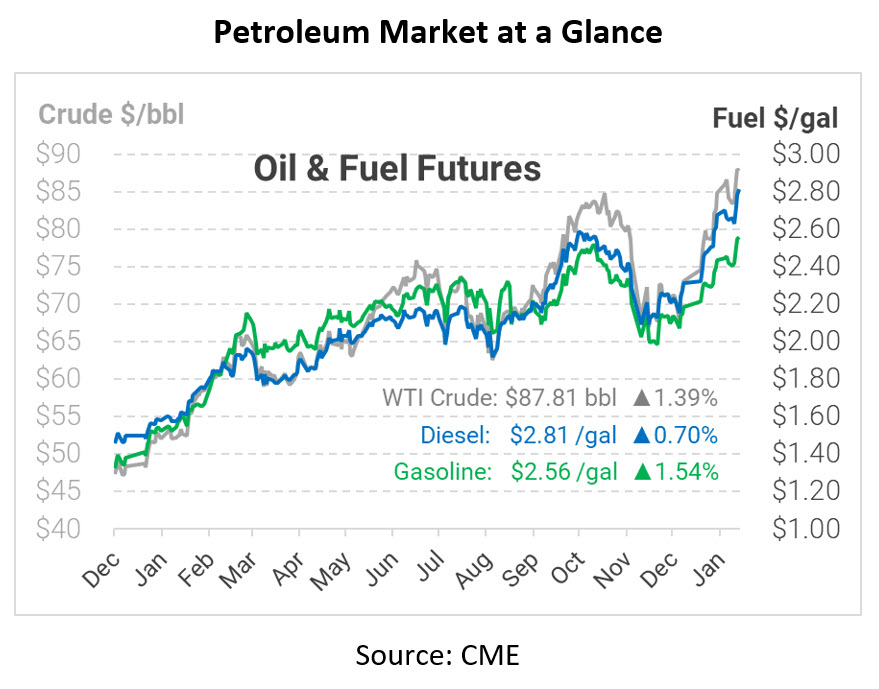

With a winter storm barreling down on the Northeast, fuel prices are continuing to ratchet upwards. Fuel prices – traded on the Chicago Mercantile Exchange as ULSD (diesel) and RBOB (gasoline) – are based on deliveries to New York Harbor, so we’ve seen the national benchmark climb as the storm approaches. Between rising crude prices and soaring demand, diesel prices are up 50 cents over the past month, and gasoline is up 30 cents.

The most recent challenge is an impending Nor‘easter, a storm pattern resembling a winter hurricane. The storm will cause blizzard conditions and possible power outages in New England tonight and tomorrow. Cold weather will drive up heating oil demand, increasing local prices. Moreover, since northeast markets rely heavily on barged fuel imports from Europe, the storm could briefly disrupt shipments and loading. Put together, the approaching storm will continue driving prices higher today, but prices may improve a bit on Monday.

Price pressure isn’t confined to the US, however. Around the world, diesel supplies are growing tight. Europe’s largest refinery has begun maintenance that will briefly shrink supplies. In the US, refiners have had to switch focus to gasoline to keep up with surging consumer demand, detracting from diesel streams. In Asia, China has cut its fuel export quotas, meaning that their East Asian trading partners will have to secure imports from other countries. These challenges come as diesel inventories are already low. Expect surprise events – like the winter storm in the Northeast – to push fuel prices dramatically higher given the lack of supply chain slack.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.