Prices Positioned for Largest Single-Month Gain in Over A Year

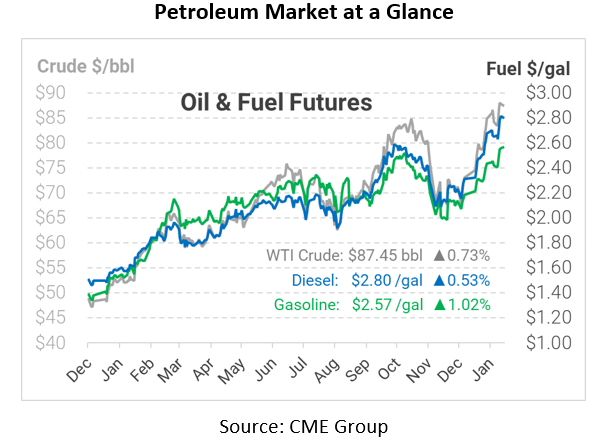

This morning, oil prices are still increasing and are on track to have their highest monthly gain in well over a year. From the beginning of January to today, prices have seen a 14.7% increase. The current supply shortages combined with tensions in the Middle East and the Ukrainian border are pushing prices steeper upward with no immediate end in sight. This morning Brent crude rose 87 cents to $90.90, and WTI crude reached $87.29 per barrel, showing how price increases show no signs of slowing down.

With the ongoing conflict in Ukraine still fresh, NATO has started to become more vocal about the situation. Yesterday the head of NATO stated that it was time for Europe to start thinking about diversifying its energy supplies. According to General Jens Stoltenberg, it is “highly” likely that Russia, the largest natural gas supplier on the continent, could invade Ukraine immediately. With over 120,000 Russian troops currently on the border and thousands more arriving daily, signs of pulling back by the Kremlin are far from sight. The main problem for the United States and members of the North Atlantic Treaty Organization is that because Ukraine is not officially part of NATO, there is not much to do until a situation becomes hostile.

In the Middle East, tensions between the UAE and the Yemen Houthis continue to escalate. This morning it was reported that the UAE government intercepted a ballistic missile targeted at the country. This is getting more serious as the Israeli president is in the region for his first visit to the UAE. While the Houthis have claimed responsibility for both the prior drone attack and today’s ballistic missile launch, it is unclear what the immediate response of the UAE will be. With gradual production increases by OPEC+ still expected, and no immediate pressure released off markets, this week could see prices continue to be bullish until a decision comes on February 2nd at the OPEC+ meeting to change current output levels.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.